Moroccan tomato imports have been the reason behind the staging of new protests by several associations and producer organizations in France, which have been backed by the Spanish sector.

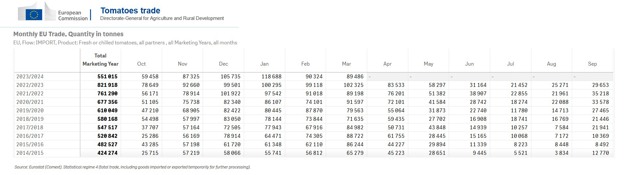

The reality is that the amount of tomatoes imported by the EU from third countries has drastically increased over the last decade. According to figures shared by the European Commission, between the 2014/15 and the 2022/23 campaigns, the amount of tomatoes acquired by the European market has increased from 424,274 tons to 821,918 tons. During this period, the volume coming from Morocco has increased from 329,696 tons to 539,307 tons, and accounted for 65.6% of the total last campaign.

Specifically, in this 2023/24 campaign, from October to March, the EU imported 551,015 tons of tomatoes from third countries. Of these, 373,421 tons came from Morocco. But where did they go specifically?

According to the data provided, France, with 293,113 tons, is by far the largest buyer of Moroccan tomatoes, absorbing 78.5% of the tomatoes shipped to the EU by the North African country. In fact, Moroccan tomatoes accounted for 98% of the tomatoes purchased by France from third countries during those five months.

And this volume from Morocco has been added to the supply from other origins, contributing to the significant drop in prices experienced in Almeria during the winter tomato campaign.

"Since the end of December/beginning of January, the development of the campaign has been hurdled by these low prices, and to this day, we have not managed to recover. Luckily, the beginning of the campaign was very good, with rising prices," says Julián Rodríguez, a producer from Almeria and member of CASI. "It should be said that the good weather, not only here, but also in the rest of the producing countries, has resulted in an excess of production everywhere. So far, we have been handling several million kilos more than last campaign, even with the low prices and crops being withdrawn prematurely."

"However, looking at the export data from Morocco, we are surprised that Europe is not controlling what is being sent. If we look at England, the figures say it all. Except for some specific customers, England is buying almost exclusively Moroccan tomatoes, which further complicates the situation," he says.

"That's why we are betting on specialties as a way to differentiate ourselves in the market, like the pink tomato, which is highly consumed here in Poland, and which we can deliver with a very good quality and a long shelf life that makes them ideal for export."

"Also, this year we will be able to start the campaign earlier than last year, so we will have the advantage of having product sooner. In the 2023/24 campaign, what most influenced the delay in its start was the fear to the tomato rugose virus, but this year we already have resistant varieties, so we hope that the campaign will be brought forward by at least 20 days, which will mean arriving in the market a month or 40 days earlier."

"When the Netherlands or Poland are about to finish with lower quality tomatoes, we will be able to arrive earlier with a new crop while there is a high demand and good prices. Morocco won't be able to start so soon due to the heat in the country, but here in Almería we are in a privileged area to produce tomatoes."