Amid extreme market volatility and record-high prices, fertilizer consumption suffered in 2022. According to a new Rabobank report, a recovery in consumption is possible in some regions in 2023, with fertilizer prices lowering and commodity prices at historically high levels.

When geopolitics meets fertilizer markets, things get bumpy for fertilizers. That is exactly what has happened over the past two years, with tensions peaking after the invasion of Ukraine. But for 2023, we can expect things to settle somewhat, says Bruno Fonseca, Senior Analyst – Farm Inputs at Rabobank. “Price movements during these past months have borne a resemblance to those of certain periods in the past. History repeats itself. That becomes more evident when we explore historical trends in the affordability index over time.”

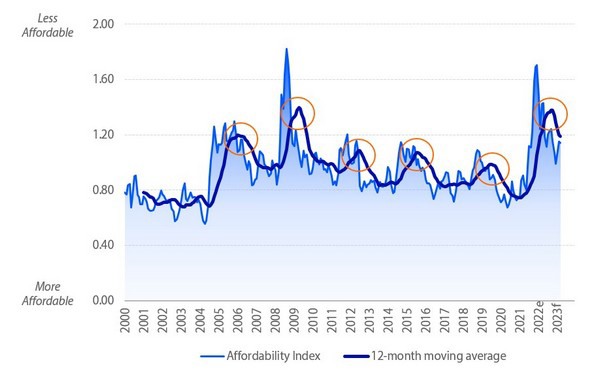

The affordability index shows the relative price of a basket of commodities in comparison to a basket of fertilizer. Current price trends and volatility are in line with a three-year cycle of peaks. If history is to be believed – especially trends observed following the 2008 Global Financial Crisis – then prices should come down in the coming months.

Fonseca: “The index’s moving average is trending lower as fertilizer prices are returning to pre-war levels. For the next three months, the index will continue to trend downward but remain above normal. The key point of attention is on nitrogen products, as the natural gas crisis in Europe has the potential to make urea and ammonia more expensive and, therefore, to keep the index at a high level.”

Fertilizer markets outlook

The nitrogen-based fertilizer market is the most volatile among all fertilizers due to its intrinsic connection with oil and natural gas markets. Thus, as those commodities become more volatile, urea and ammonia prices are expected to go with the tide. The 2022 annualized volatility of urea prices up to mid-October was above 60% – three times more than the five-year average. As long as the natural gas crisis in Europe lasts, volatility in the nitrogen-based fertilizer market will persist, with weeks of stronger demand pushing prices higher and weaker weeks pushing prices lower.

Phosphate fertilizer prices are trending lower, as demand was destroyed by the high prices observed this year. Still, high production costs should prevent big decreases in prices. Logistics remains a risk, as does adverse weather affecting application windows. These factors could deliver material volatility in the otherwise quiet market.

The spike in the potash market destroyed demand. Now, prices are moving lower to regain that demand. The continuation of exports from Belarus and Russia is resulting in a rearrangement of global supply, further pressuring prices.

High commodity prices support demand

The high commodity prices of the past two years have given producers outstanding returns and strong working capital positions. Higher input costs mean producers’ margins will be lower in the 2023 growing season than in the past two years, but margins will still be positive. “With strong working capital and positive margins, producers will make minimum cuts to inputs,” predicts Fonseca. “Their objective is to maximize yields, and that is not accomplished by cutting back inputs, particularly fertilizers.”

The affordability index reveals a slight downward trend over the next three months

Source: Rabobank 2022

Source: Rabobank 2022

Find the link to the research here.

For more information: Rabobank

Rabobank

www.rabobank.com