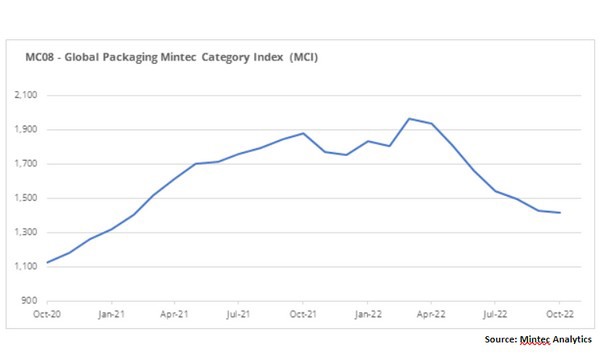

The Mintec Global Packaging Category Index (MCI) declined in October 2022, down 1% month-on-month (m-o-m) to USD 1,414/MT. The decline in the index appears to be slowing and seems close to hitting a price bottom. However, it is still possible that there may be a further decline in the price of raw materials, combined with lower demand. Energy prices, which have fallen slightly since September, may begin to rise during the winter months.

Plastics

In October, prices in the plastics market in the EU and the US showed a decline. Prices in the US fell at a sharper rate. What stood out was price stabilization and fixing deals in the European PP market.

EU HDPE and LDPE prices in October followed the same downward trend. HDPE declined 2% m-o-m and 5% y-o-y to EUR 1,678/MT. The LDPE price was EUR 2,043/MT, down 1.4% m-o-m and 7% y-o-y. Prices have fallen for five consecutive months, but the rate of decline has been slowing. Production cuts have led to a more equal balance between supply and demand, and this has been reflected in prices. Lower demand has also forced suppliers to reduce prices.

However, producers no longer appear willing to make serious concessions, having realized that prices are close to a bottom. PET prices in the EU fell 3% m-o-m in October to EUR 1,613/MT, but it is worth noting that this is a slower rate of decline compared to the 7% decrease in September. The price is up 26% y-o-y. Weak buying activity reflected poor demand amid fears of a recession, even for cheaper imported products.

Full warehouses also meant that buyers could afford to pause and wait for prices to fall. The PP price in October stabilized, and due to increased consumer activity, there may be a slight price increase in November. The average PP price in October was EUR 1,605/MT, down 13% y-o-y. There was buying activity in the market, which indicates that a balance has been reached between supply and demand.

Click here to read the full press release on mintecglobal.com.