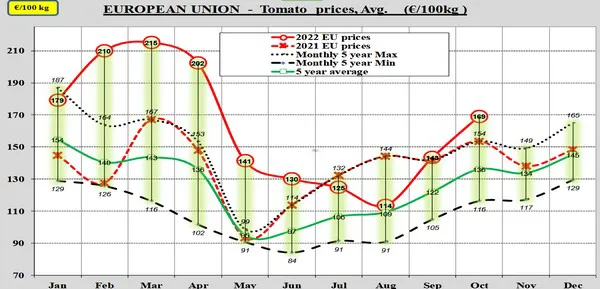

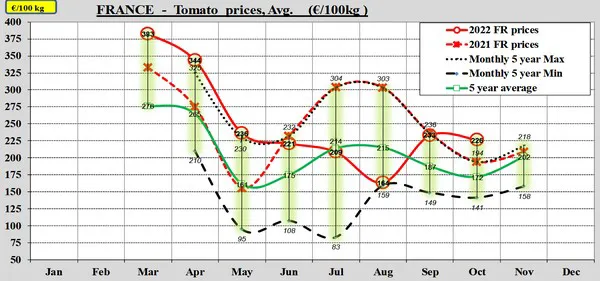

Cost-wise there are challenges in the tomato market, but price-wise records continue to be set. This includes October. Across the board in Europe, prices were again averaged well above the five-year average, and the peak price of the past five years was also well exceeded.

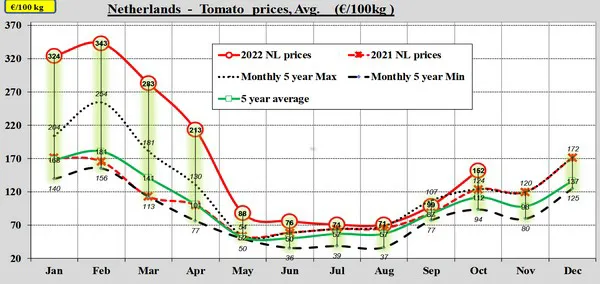

The Netherlands recorded the biggest peak, although, as usual, the price per kilo still cannot match those in other countries. All this is shown in a new update of the European Commission's tomato dashboard.

Switchover

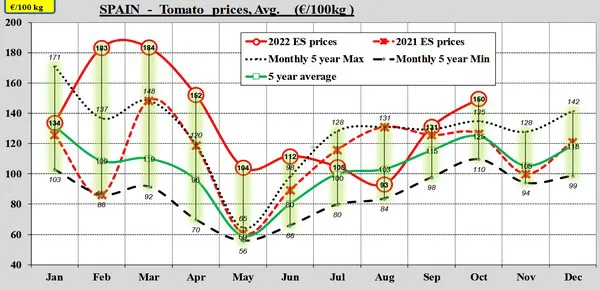

Compared to September, prices continued to rise sharply. A price hike in autumn is not unusual when volumes in north-western Europe decrease and production in the south cannot yet compensate for everything. This year, that situation is even more extreme, as growers forced by high energy prices sometimes stopped growing in greenhouses in north-western Europe earlier. In Spain, acreage did increase (percentages of around 15% more plantings are mentioned).

Highest increase in the Netherlands

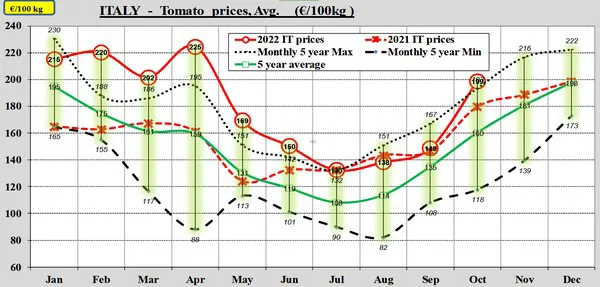

The largest percentage deviation from the usual price rise in October can be seen in the Netherlands. Over the past five years, the price rose 28% on average from September to October. This year, it was 54%. Spain (14% in 2022 to 8% over the past five years) and Italy (34% to 19%) also saw a larger percentage increase in prices. In France, prices traditionally fall, but there is still a more slight drop in prices here (-3% to -8%).

Kilo prices

Despite the substantial price rise in the Netherlands and also Spain, average kilo prices in both major tomato countries are below the average price across the European Union. Against that kilo price of 1.69 euros, the Netherlands (1.52) and Spain (1.50) cannot compete. Over the past five years, the record price for October was €1.24 in the Netherlands and €1.35 in Spain.

In Italy, the October price is only narrowly above the record of the past five years. A kilo here yielded an average of 1.99 in October 2022, against 1.93 as the record price previously.

Prices sank mid-October

Belgium has not been included in the dashboard by European statisticians. On the page of the Flemish Ministry of Agriculture and Fisheries, figures from the Federation of Belgian Horticultural Cooperatives do give an idea of the tomato month of October. In September, prices here were well above the five-year average, after which prices started to fall from week 42 onwards. In week 44, at the transition between October and November, prices briefly dropped below the five-year average. Prices for loose tomatoes were slightly lower than those for vine tomatoes (there is no distinction on the tomato dashboard). After that, prices did rebound slightly.

Less exposure

In greenhouses in northwest Europe, it is now time for crop rotation. Depending mainly on energy positions and market agreements, some growers are already working towards a new planting, while others are waiting a bit longer. Cultivation under light is still there, but considerably less than usual. Autumn cultivation is also there. With this, growers towards Christmas still manage to produce tomatoes in the first real month of winter with as little energy input as possible.

November dip?

Traditionally, the price drops slightly in November when cultivation in northwest Europe overlaps a bit with the south and also imports from Morocco. With the situation this year (again) different from usual, it remains to be seen what the balance will be at the end of November. For now, prices are not yet at the levels of around mid-October.

In yet another unusual tomato year last year, there was a November dip, but not as strong as normal. Compared to last year, here in north-western Europe, lighted cultivation has shrunk even more, while production in Spain is higher, and Morocco (and also Türkiye, according to market sounds) is also gaining ground.