The second day of the Cool Logistics conference took place on Wednesday. The session Cool Ports and Cold stores: Integrated Perishable hubs of the future' was moderated by Steve Cameron, Principal, Cameron Maritime Resources.

Johannes Nanninga, CEO and Owner, Guangzhou Port (Europe) BV, representing Port of Nansha, was the first speaker in the session. He spoke about the trends in the Chinese market.

Foreign investment in China is continuing to grow, and the Chinese Government is simplifying the procedures for doing business there and thus towards making China a better partner. "China is also becoming more self-sufficient in the production of new technology and food," Johannes said.

More people in China are moving out of poverty and the middle classes are growing, which brings a higher demand for safe and healthy food with it. Although Shanghai remains one of the forerunners in this demand, other cities such as Guangdong, Jiangsu, and Zhejiang are following suit.

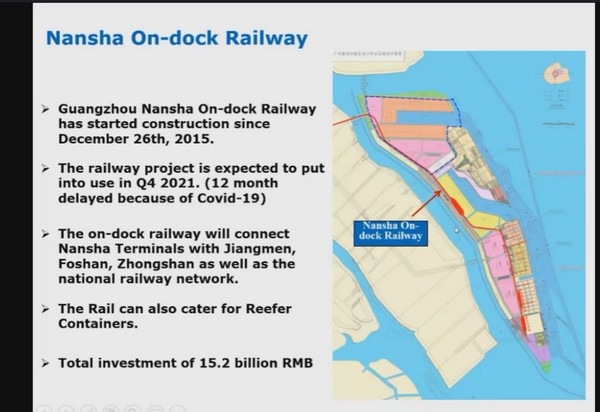

Exports from China have always been strong, and now imports are also seeing rapid growth as the population becomes more prosperous. eCommerce is a big factor in this, as is more overseas travel (pre-pandemic) where the Chinese experience other cultures and food. This calls for more connectivity between the ports and inland cities, as the distances between these can be very big.

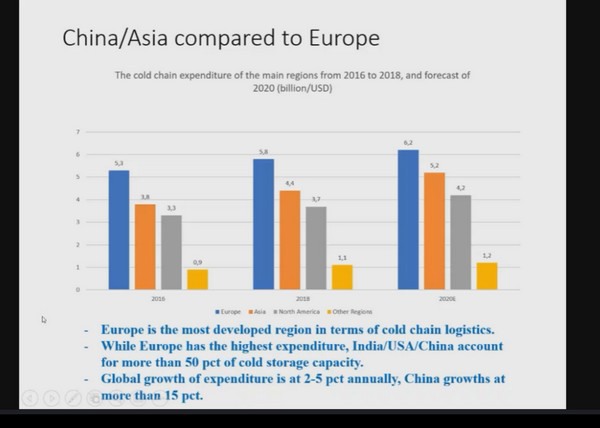

Food spoilage or waste is high due to the lack of cold chain logistics, and as fresh fruit and vegetable consumption increases, there is a need for more investments. The increase in refrigerated transport is between 30- 100%, and it is estimated that by 2025 the growth in refrigerated transport will be 100%.

"There is now more produce going directly to China instead of through Hong Kong as was the case in the past. The Port of Nansha is serviced by all of the major carriers and is well placed to supply the major fruit market in Jijangnan. There are good connections to the market from Hong Kong and Shenzhen as well," according to Johannes. Nansha will also apply for Free Trade Port status to ease customs procedures.

The bigger players in the foodstuffs trade are consolidating to improve the cold chain, but better infrastructure and hubs are still needed. Inland infrastructure improvements in retail areas are also needed to reduce food waste.

Capt. Paul J. Gallie, Director, Business Development, A.P. Moller Capital, gave the port of Limon in Costa Rica as a great example of what can be achieved when it comes to building a modern functional port.

"Ports are only as good as its hinterland infrastructure; they need deep water, but also good road and rail connections. Cold chain Logistics is about getting perishables from A to B in the best condition possible," he said.

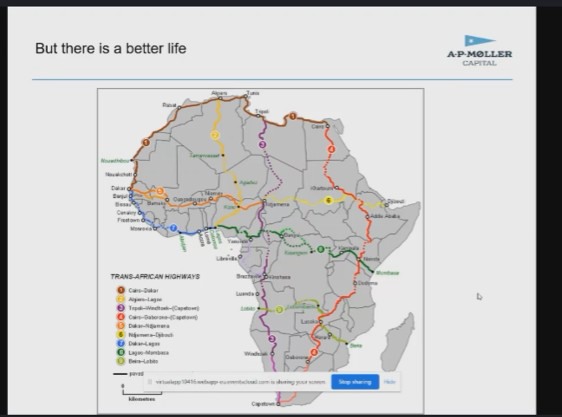

Paul stated that there are many ports in Africa that do not use the climate and rich soils optimally for growing tropical fruit, due to a lack of infrastructure. "There is potential to export bananas from Africa, it just needs the investment and help with infrastructure."

How Africa’s road network could look

On the continent of Africa, South Africa has 50% of the rail mileage. Paul sees a strong need for improvement on that continent: with a rail network, transit speeds would increase and it would be much better for the environment.

Kenya supplies 35% of the EU’s fresh flowers. This was previously done via air-freight, but this is expensive. Using controlled atmosphere temperature-controlled containers, the flowers can now be shipped by sea from Mombasa to Europe and still be fresh on arrival.

Ole Schack-Petersen, Executive Officer, Broom Group gave an outline of the services offered by the Broom Group which has been in existence for 100 years. As well as acting as agents for shipping companies, Broom group also offers inbound clearance services, assistance in documentation for import, export, and transshipment. The logistics arm of the company offers sea, land, and air transportation, packing, and cold stores.

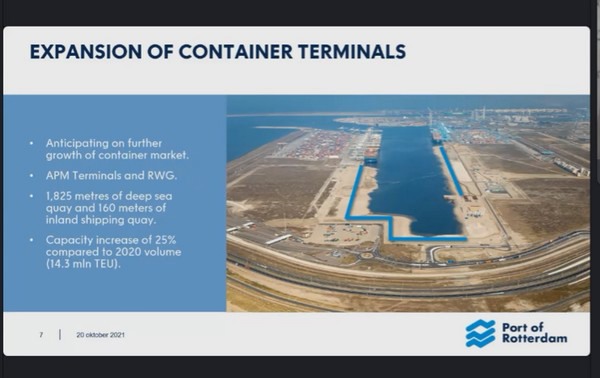

Anne Saris, Business Manager Agrofood & Distribution, Port of Rotterdam, spoke about the development and expansion of the Port of Rotterdam. The port has seen a growth of 6-8% in the last five years. They are currently developing cold storage due to higher demand.

The port aims to be a one-stop-shop for fresh and frozen goods and the gateway to Europe. Over the next few years, part of the port will be redeveloped for housing and other uses, which has driven the need to develop other areas for clod storage. A 60-hectare area in the Maasvlakte will be used for this, development has already started.

There is also a need to house dedicated reefer vessels and smaller container ships. There will be an area fully dedicated to fast and efficient handling of these vessels and a cold store adjacent to the quay.

The port is also digitalizing the infrastructure to optimize the shipping process. This includes an automated customs process for goods to and from the UK, to achieve cost and time savings.