The effect of the pandemic has been felt in the UK tomato market, as it has in many others, but in a positive rather than a negative way. Over the last year, the tomato market has increased by 2.1% in value, as well as 4.5% in volume. According to Rikesh Panchmatia of data analytics and brand consulting company Kantar, this is primarily due to more frequent purchases.

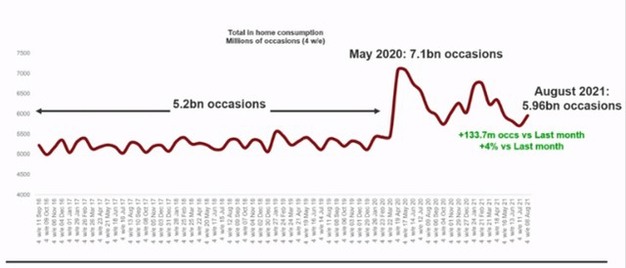

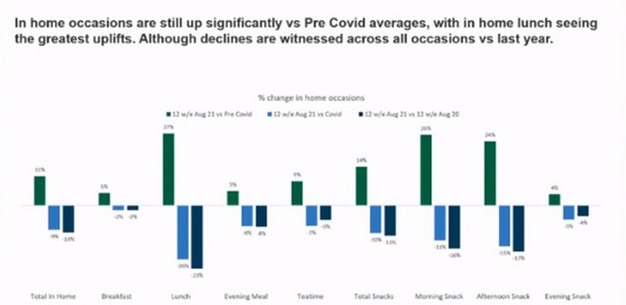

"Due to COVID-19, many consumers are now visiting supermarkets and purchasing tomatoes more frequently, from 25.6 average visits in 2018 to 26.7 in 2021," says Rikesh during last week's British Tomato Conference. "Due to the lockdowns and the closure of the restaurant industry, there were far more occasions to eat at home, as opposed to out, for instance, due to working at home. This trend was particularly noticeable in how many people consumed lunch at home, an increase of 27%. As a result, the volume of purchases has also increased over this period, from 0.42kg on average in 2018 to 0.44kg in 2021."

Sustainable trends

This positive trend for the tomato market is, however, not all good news. "This increase in consumption is fantastic, but we have to find ways to make it sustainable," Rikesh continues. "Despite its strong increase in recent years, the in-home lunch occasion has seen a faster decline than other opportunities. Although working from home is here to stay for many workers, others have returned to the office part or full time, so there needs to be a focus from the industry on these out-of-home work occasions as well."

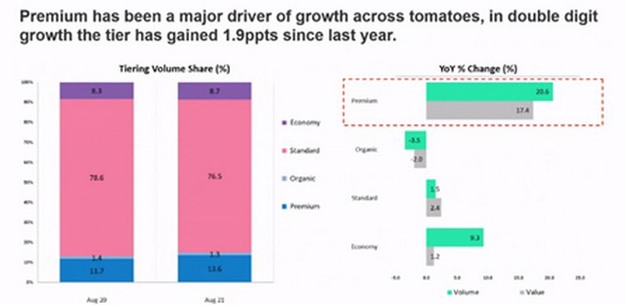

Another area where there is strong potential for increase growth in the market is in the area of premium tomatoes. "Time and time again, we see that people are prepared to pay premium prices for premium products. Vying with one another to offer the product the cheapest benefits no one; not the grower, seller, or consumers. We can really benefit from a focus on quality and desirable characteristics in tomatoes." The premium sector has seen the most growth out of all sectors in the last years, with an increase of 13.3%, bringing its share of the market up to 6.2%.

Online purchases, another rising category, are also strongly linked to premium products, as the perception of quality is key here. 17.2% of premium produce was sold through the online channel, and as a result, contributed to 56% of the growth of the premium category.

The big question, however, is how to maintain and build on these positive trends. Rikesh highlights how the current situation is both a blessing and a curse. "How the market will go over the next year or so will depend to an extent on government action. If there are more lockdowns, we could see the trend continue due to the circumstances. We need to build on the momentum we have at the moment and try to retain these levels of consumption and grow them. Over the pandemic, there has been more focus on healthy eating, so as an industry, we should promote the health benefits of tomatoes, for instance, as a healthy snack at the desk as people go back to work, or look at what products they can be paired with, for instance in a salad. There is an opportunity here to fill gaps in the market, but we have to work with the consumer and learn what they want. What are the optimal pack sizes, what are tomatoes being consumed with? These are questions we need to look at to continue the growth we have seen in recent years."