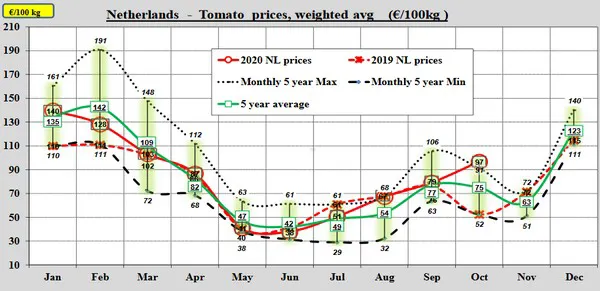

Despite a difficult summer in the tomato market, prices have risen this fall. This results in above-average prices in October, with a peak average of € 0.97/kg for tomatoes from the Netherlands. That's even higher than the five-year maximum.

This means that a remarkable tomato season will end on a positive note, at least for lighted cultivation.

However, it is still important to differentiate the various tomato segments and in some cases, the season is still 'bleak', especially loose tomatoes that are meant for the hospitality industry have taken the most hits. TOV did a little better.

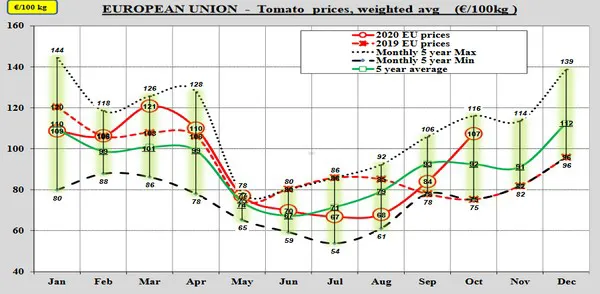

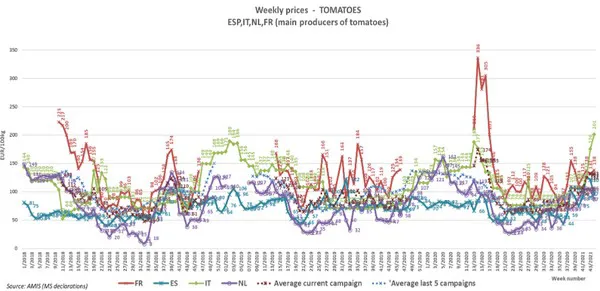

Looking at the figures for the European market, compiled in the European Commission's tomato dashboard, we see that with € 1.07/kg the average price until week 43 is higher in October than the five-year average of € 0.92/kg. We're even approaching the five-year maximum of € 1.16/kg.

Click here to enlarge

The Netherlands manages to surpass that five-year maximum. On average, no more than € 0.91/kg was paid these last five years. This year it is € 0.97/kg.

However, it should be noted that the productions were lower this fall, with the heating effect on plant growth not only felt in the Netherlands.

The figures also show that in a market with traditionally small margins, the average price in the Netherlands rose above the five-year average from July onwards. In September, the price level of 2019 was equaled, but where prices dropped in October of last year, the price is now reaching record levels.

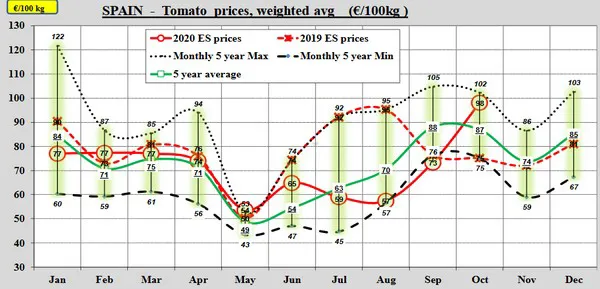

Record levels are just short of being reached in the south of Europe, but they also have high average prices. In Spain, the difference is € 0.04/kg, and with € 0.98/kg the five-year record of € 1.02/kg is almost equaled.

Unlike in the Netherlands, the average price outside the peak season was below the five-year average since July. The good prices at the start of the season in October change this. In Spain, the tomato acreage has fallen once more.

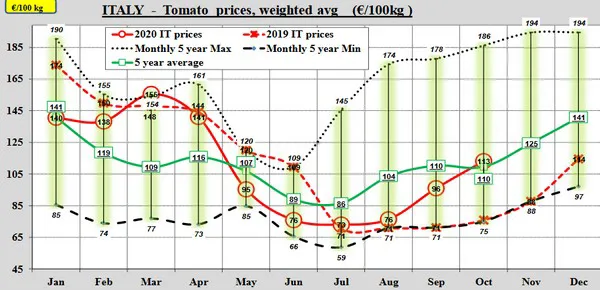

In Italy, the five-year record has been far out of reach since July. In the record year, the average price came close to € 2.00/kg towards November and December. That is unthinkable now. However, for the first time since May, the average price is just coming above the five-year average with € 1.13/kg.

In Italy, for example, the Tomato brown rugose fruit virus (ToBRFV) is causing serious problems for growers, resulting in production losses. Other viruses and the weather conditions also resulted in lower productions, sometimes as low as 40-50%, which means that demand cannot be met everywhere.

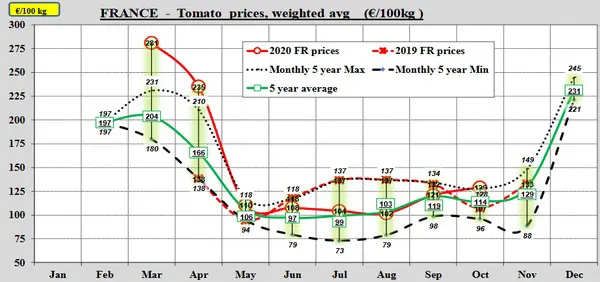

France is the fourth and last country on which the European Commission reveals the figures in the dashboard. France has relatively limited domestic production compared to the three countries mentioned above, while the market is characterized by higher average prices for one kg of product.

At € 1.29/kg, the average price for 2020 in October moves away from the five-year average, after the average for 2020 fell slightly below the green line in August.

TOV better off than loose tomatoes for the remainder of the year

For the remaining month and a half, expectations are good, with, as we have seen, better price prospects for TOV than for loose tomatoes. There is a lot of uncertainty in the market due to both the coronavirus (and to a lesser extent the Brexit deal), of which the hospitality industry has the most to fear.

Lighted cultivation in the Netherlands will start production five weeks later, which means there is less import and less overlap with non-lighted cultivation. The first tomatoes will be harvested starting this week. TOVs are expected to yield good prices, loose tomatoes not as much. The latter group comes mainly from the south, where acreage has fallen in Spain, while Morocco is increasingly becoming a serious competitor in the market.