Entering the latter half of August, the very different nature of this year’s back-to-school season is becoming evident. Wave 17 of the IRI COVID-19 shopper impact survey, conducted between August 7 and 9, finds a growing number of parents reporting their school-aged children will be partaking in virtual education only.

There is, however, some indication that the stocking-up behavior is starting to ease, according to the IRI survey. Parker added, “Down from 41% in early July, still 34% of shoppers remain focused on making fewer, larger groceries trips to minimize in-store visits. And down from 30%, now only 25% are stocking up on pantry staples/essentials more than usual."

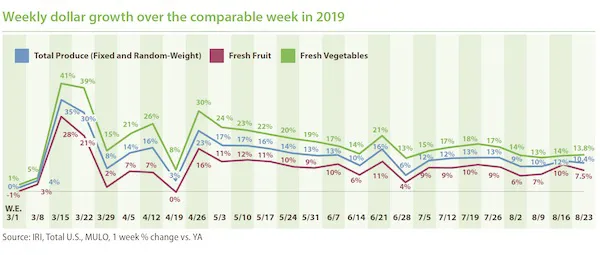

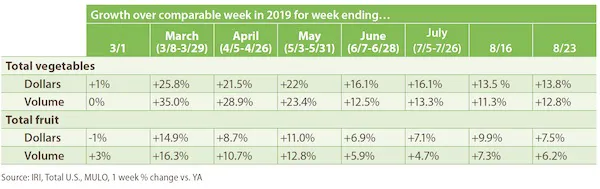

The net effect for fresh produce was a near mirror week of the last based on strong everyday demand that sits about 10% above last year’s levels. For the week of August 16, fresh fruit and vegetable sales increased 10.4% over 2019. Frozen fruits and vegetables had a much higher percentage increase, but is the smallest of the three temperature zones. Year-to-date through August, fresh produce department sales are up 11.2% over the same time period in 2019. Gains for shelf-stable fruits and vegetables were lower than that of fresh driven down primarily by single-digit (+9.6%) growth for shelf-stable fruit. Frozen fruit and vegetables increased the most, up 27.0% year-to-date.

- Fresh produce increased +10.4% over the comparable week in 2019

- Frozen, +21.0%

- Shelf-stable, +13.6%

Source: IRI, Total US, MULO, 1 week % dollar growth vs. year ago

Fresh produce

The small decline in fresh produce buyers during the 26-week period ending August 23rd versus the same period in 2019 was easily offset by higher trip conversion and spend per trip. Household penetration dropped a slight 0.2%, but when in-store, more consumers purchased fresh produce, boosting the number of fresh produce trips by 5.9%. Additionally, they spent more per trip, up 7.6% and more per buyer, up 13.8%.

Fresh fruit also saw a jump in product trips, spend per buyer and spend per trip, but not to the extent of fresh vegetables. This explains the superior performance of fresh produce throughout the pandemic.

Fresh vegetables improved all measures: buyers, trips and spend per trip/buyer, which has translated in all those months of double-digit gains for vegetables.

Fresh produce generated $1.31 billion in sales the week ending August 23 — an additional $123 million in fresh produce sales over the prior year. This is below the pandemic average for additional dollars, at $179 million per week, as everyday demand is settling in around that +10% above year ago.

Fresh share

The fresh produce share of total fruit and vegetable sales across all three temperature zones was 81.4% during the week ending August 23 — eroding a little each week with a continued elevated share for frozen items. “Frozen foods in general have seen very strong pandemic sales,” said Parker. “Frozen foods, including fruit and vegetables, have seen an increase in basket size, buyers and trips.”

Fresh produce dollars versus volume

Ever since the week of May 24th, dollar gains have outpaced volume gains, but this week the gap narrowed to just 1.5 percentage points, much lower than last week’s 2.6 points. However, a look at category-level inflation and deflation across categories is important as throughout the pandemic period, items with high inflation versus deflation have been counterbalancing each other.

Both fruit and vegetables saw dollar sales gains track ahead of volume gains. Vegetable volume growth remained in double digits during the week ending August 23.

To read the full report, click here.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

Email: [email protected]

www.210analytics.com