sennder, a digital freight forwarder in Europe, has released its second European Road Freight 2023 Year in Review, a market report focusing on the key industry-shaping trends of 2023, based on proprietary data from its network of approximately 40,000 trucks. The report provides an analysis of the road freight industry landscape with an outlook on the trends that will impact the industry in 2024.

Julius Koehler, Co-founder and Managing Director at sennder, said: ""2023 was another unprecedented year for our industry. Against a backdrop of continued market volatility and the ever-present urgency of climate action, we see shippers and carriers seizing technological opportunities and adapting to new environmental and regulatory demands. The outlook for 2024 is clear: Digitalization is key to navigate lower shipper demand and persisting macroeconomic challenges.""

Declining road freight rates in Q1 2023

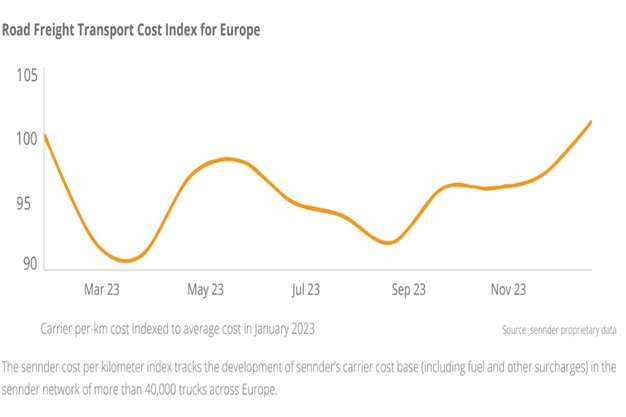

2023 was a challenging year for the industry, with adverse global macroeconomic conditions taking their toll on shippers and carriers alike. Road freight demand, often a barometer of economic health, witnessed a downturn after the all-time high freight rates seen in 2022. Faced with the need to secure loads, carriers engaged in low-price strategies, driving down freight rates, with sennder identifying road freight rates falling as far as 9% in Q1 2023.

Yet, European carrier rates were up 1% above January 2023 levels by EoY. This was caused by peak season demand and new German road tolls from December 2023, which increased toll costs by up to 83% for carriers operating on German roads. German freight rates ended 2023 up by 6%, which sennder identified as being driven by these increases in cost.

Navigating the spot decline

The spot market saw a downturn in 2023, with sennder observing a 47% decline in market spot opportunities YoY. Unfavorable macroeconomic conditions suppressed consumer spending and business orders, leading to sustained excess truckload capacity.

During the freight' 'peak season'' (Black Friday weekend to the end-of-year holiday season), there was a lower peak in comparison to the past two years, with shipper orders down due to the decline in consumer spending. Despite this, sennder's' truckload volumes still peaked at 65% above average in the last week of November 2023, with many cost-conscious consumers waiting for Black Friday discounts before making significant purchases.

Julius Koehler, Co-founder and Managing Director at sennder, said: "In light of ongoing market volatility, sennder continues to expand its Control Tower business model for sustainable growth: We take over 100% of our customers' FTL business and digitize all parts of the interaction. This unleashes value for our customers, which is primarily in the form of lower costs. In this way, we build a reliable demand for base volumes, contracted loads, and, on top of that, spot loads. This remains a priority for 2024."

For more information:

Marisa Wagner

sennder

Tel.: +49 1525 437 2777

Email: [email protected]