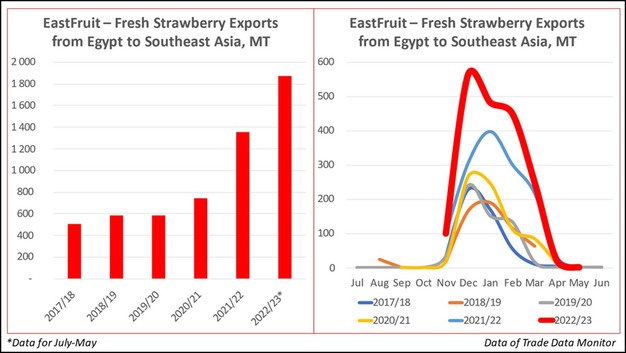

Egypt has again set a record in exports of fresh strawberries to Southeast Asian countries in the current MY 2022/23, reports EastFruit. The Egyptian exports to this region have grown by a third year-over-year and tripled over the past four seasons! As a result, Egypt has remained the fifth largest exporter of fresh strawberries to Southeast Asia but has continued to cut the distance from its main competitors here.

In the first 11 months of the current MY (July 2022 – May 2023), Egypt exported 1,900 tonnes of fresh strawberries to the Southeast Asian market. Given that the Egyptian exports are usually close to zero in June, the final result of the current MY will not change drastically.

Growing exports to Southeast Asia are based on Egyptian export diversification by adding alternatives to more traditional markets, such as the EU, Russia, and the Middle East. As a result, the Egyptian fresh strawberry exports to Southeast Asia have been annually growing by a third on average since the MY 2019/20.

Southeast Asia is not among the key global importers of fresh strawberries, but it still gives excellent opportunities to exporters of high-quality berries with access to aviation logistics. Annually, the Southeast Asian countries import up to 16,000 tonnes of fresh strawberries.

The situation with imports is different in the region. Hong Kong, the regional leader in imports, has been annually reducing imports of fresh strawberries, with current import volumes being a quarter lower than five seasons before. The demand for imported strawberries has also decreased in Taiwan (from 940 tonnes in the MY 2017/18 to 800 tonnes in the current MY). Imports in Singapore are stable and annually vary between 3,600-3,700 tonnes.

Meanwhile, Malaysia has increased the import volumes by 60% over the past five marketing years, and they reached 2,600 tonnes. Thailand has increased the imports by a quarter to 2,200 tonnes, while Macao has doubled them to 430 tonnes. Imports have also been growing in Indonesia and Cambodia, but their volumes are still quite low: respectively 230 tonnes and 270 tonnes in the first 11 months of the current MY.

Just five exporting countries cover 85-90% of the total demand for fresh strawberry imports in Southeast Asia, and three of them have been reducing their exports. The list of such exporting countries includes the USA (-5% from the result of the MY 2017/18), as well as South Korea (-34%) and Australia (-6%). Meanwhile, imports from Egypt and Japan continue to grow, but these countries still export less strawberries to Southeast Asia than the leaders. China has also been developing the Southeast Asian market, and the fresh strawberry imports from China have grown by half to 570 tonnes.

For more information: east-fruit.com