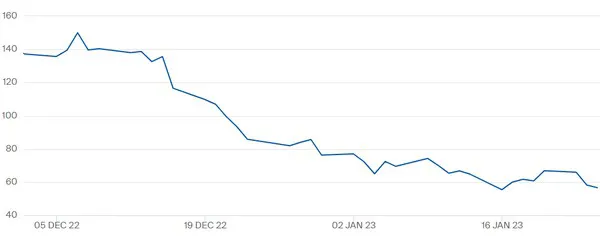

On Wednesday, the short-term TTF gas price again dropped to a, by crisis standards, low. 56.66 euros per megawatt-hour was the lowest price since December 2021. The electricity price has also been dropping in recent days. On Thursday, that decline continued. The gas price hovers below the 60-euro mark.

The TTF gas price for February 2023 to 25 January. On Thursday morning, the gas price continued to move below 60 euros per megawatt-hour, the same as on Wednesday. Click here for current figures.

The APX day ahead electricity price for the base hours is at 147.99 euros per megawatt hour on Thursday and 156.96 euros for the peak hours (between 8-20 hours). In the BELPEX market, prices are at 172.55 euros for base hours and 190.30 euros for peak hours. Winds picking up in the coming period means that electricity prices are expected to fall, analysts at energy supplier Vattenfall also write.

An uncertain weather picture for the coming weeks has seen many price fluctuations in recent days, they also note. "Due to the current oversupply of gas, gas prices are lower than those for the coming winter. This makes the spread between the upcoming summer and winter months very favorable, making it interesting to replenish gas stocks in summer. This reduces the risk of any gas shortages for the coming winter." Read the update here.

For now, European regulators ACER (energy) and ESMA (financial markets) have not identified any significant effects (positive or negative) that can be unambiguously and directly attributed to the adoption of the Gas Market Correction Mechanism (MCM). It should not be inferred from this that there will be no future effects on the markets, writes the Association for Energy, Environment, and Water (VEMW). The VEMW is the knowledge center and advocate for business energy and water users. It says it will respond to the method of analysis and preliminary results of the study by the above parties.

VEMW writes: "ESMA notes that it seems likely that potential effects and risks arise as market participants adjust their behavior to avoid activation of the market correction mechanism and/or manage risks in case of activation of the MCM. While this behavior appears rational on an individual basis, it could cause significant and abrupt changes to the broader market environment, which could affect the orderly functioning of markets and, ultimately, financial stability. Thus, it should not be inferred from the preliminary analysis that the MCM may not affect financial and energy markets in the future."

BNR reports that the oil price remains stable even as China wakes up from its COVID-19 standstill. Last week, the oil price faltered more than this week, writes based on reports from news agency Bloomberg.

The Dutch cabinet wants to sell Tennet's German branch against the grid operator's wishes. The NRC reports. The state is negotiating the sale of part of power grid operator Tennet. That deal could raise many billions but is politically sensitive. According to a report published last year, "an integrated Tennet is of great strategic importance" for the Netherlands, the newspaper writes. Read more here.