Despite some consumers pointing to planning to eat out less often to save money during these inflationary times, 80 percent of consumers have ordered from or eaten at a restaurant in the past few weeks. Restaurant engagement is far higher among households in their prime child-rearing years: Older Millennials and Gen X, shoppers ages 32 to 56.

“Those early pandemic months saw lower consumer mobility and more time in the kitchen,” said Jonna Parker, team lead Fresh at IRI. “As life’s hecticness has resumed, the eternal battle between time/convenience, healthfulness, and money has intensified in the past year.”

“Inflation, COVID, and consumer mobility continue to change shopping and consumption patterns,” said Joe Watson, VP, retail, foodservice & wholesale for IFPA.

The July edition of the IRI monthly survey of primary shoppers underscores the market complexity.

- Awareness of grocery inflation is widespread, and consumers list examples of price inflation across virtually every department in the store.

- Unchanged from last month, eight in 10 grocery shoppers made changes to what and where they purchased.

- Sales specials, while popular, are only slowly gearing up and are still far below pre-pandemic levels.

- The share of home-prepared meals dropped to its lowest point in years, at a consumer-estimated 78.2 percent of all meals.

- Online shopping jumped up in July to 19 percent of trips.

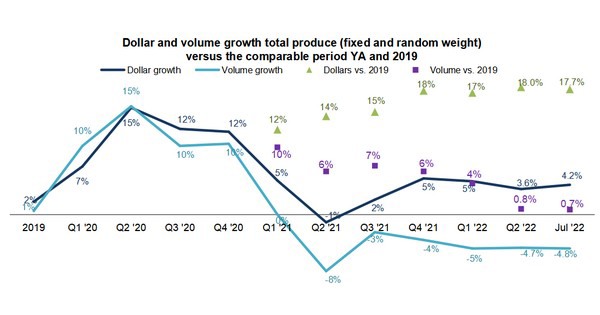

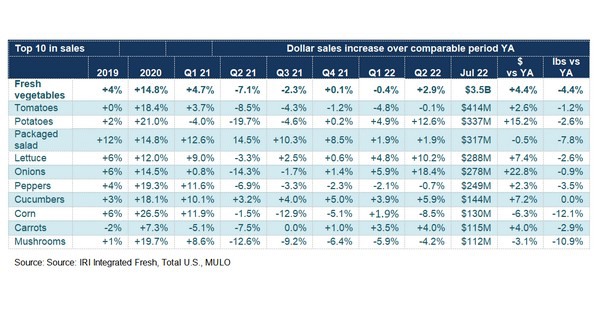

July 2022, fresh produce sales reached $7.7 billion, surpassing the record set the prior year by +4.2 percent. However, looking beyond dollars that were highly affected by inflation, unit and volume declined versus July 2021. Vegetables were down slightly less than fruit.

Each of the July weeks generated right around $1.5 billion in fresh produce sales. The first week, the holiday week, was the strongest, but sales held remarkably steady throughout the month. “In the fourth quarter of 2021 and the first quarter of 2022, the sales performances of fruit and vegetables were far apart,” said Parker. “In July, they are converging right around +4 percent dollar growth.”

“In the fourth quarter of 2021 and the first quarter of 2022, the sales performances of fruit and vegetables were far apart,” said Parker. “In July, they are converging right around +4 percent dollar growth.”

The fresh share of the business has been rising steadily. July 2022 shows that consumers are not switching out of fresh produce out of inflationary concerns.

“While berries were the biggest seller in July, the gap with the number two, melons, was by far not as big as we’ve seen,” Parker said. “In part, this has to do with below-average inflation, but we also saw cherries come on strong and mixed fruit moving back in the top 10 sellers due to the Fourth of July sales spike.” July’s vegetable performance was very mixed,” said Watson. “While most top sellers increased dollar sales, none saw volume increases. A stark illustration of the difficult marketplace.”

July’s vegetable performance was very mixed,” said Watson. “While most top sellers increased dollar sales, none saw volume increases. A stark illustration of the difficult marketplace.”

The next report, covering August, will be released in mid-September.

Please click here to see the full report.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

aroerink@210analytics.com

www.210analytics.com