Australian supermarket retailing, on the face of it, has a strong market structure. But, as in North America and Europe, the sector has experienced structural pressures over 10 years or more, with discounters acting as the main agents of change, added to emerging online pressures.

"A supermarket retailer’s fresh offering must be strong to retain short, medium and long-term competitiveness. A poor fresh offering will lose customers, a strong fresh offering will drive regular repeat foot traffic and loyalty," explains Scott Ryall from Rimor Equity Research.

"Given the trend toward healthier eating and the role of fresh in convenience propositions and as a competitive differentiator (quality, range and presentation), category growth is expected to stay strong. With feedback from 50 FMCG contacts in North America, Europe and Australia, we identify critical success factors for a supermarket’s fresh offering over the next 3-5 years, the importance of management approach and in-house expertise required, and highlight some of the reasons for historic inconsistent delivery."

Technology advances and the introduction of data, integrated systems and infrastructure create an opportunity for supermarket retailers to improve their fresh offerings over the next 3-5 years.

"Critical changes to retailer approaches that we expect in the next 3-5 years are improved tracking of provenance for food safety reasons; supermarkets developing more strategic relationships with suppliers; use of data to optimise ranging and enable localisation and personalisation; use of technology to assist in health and wellbeing branding; and more rapid developments of supermarket convenience offerings. At this stage we see Woolworths as furthest advanced, although note that Coles is making a number of sensible moves in this area. Metcash looks most challenged and is under-represented in this area."

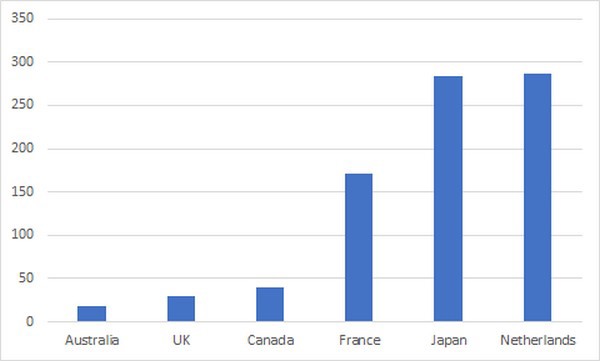

Greenhouse area (Ha) per million pop comparison

Scott sees a material opportunity for suppliers to create value given all supermarket retailers are looking to improve their fresh offerings over the next 3-5 years.

Greenhouse vs field production kg/sqm efficiency

"More of the same will not guarantee success. Adherence to governance and sustainability standards is a prerequisite. Innovation satisfying increased demand for health products and convenience offerings offers a significant opportunity. Scale does not shield a supplier from price risk, per Costa and Ingham’s recent results. However scale is critical for medium-term profitability and competitiveness and for dealing with large supermarket customers.

"Going forward, scale will become more important investing in technology to improve production efficiency, the end-to-end supply chain and continuity of quality supply. It is also important for building a brand, which we see as a stronger opportunity than has been the case historically."

Rimor Equity Research published a 200 page report on June-19, analysing the value chain for supermarkets' fresh offerings and how it would likely change over 3-5 years.

"We believe this report makes compelling reading for suppliers of fresh offerings to supermarkets over the next 3-5 years as it analyses the inter-relationship between supermarkets and fresh suppliers, particularly focused on how the relationship is likely to change over the medium-term."

The report analyses the corporate strategies of Woolworths, Coles and independents, as well as the stock market drivers behind the decision-making. It utilises insights from an experienced industry consultant, who is familiar with the strategies of both supermarkets and fresh suppliers and also comes after speaking to more than 50 industry contacts across North America, Europe and Australia to incorporate global trends.

For more information:

Scott Ryall

Rimoer Equity Research

Tel: +61459110791

scott.ryall@rimorequityresearch.com.au

www.rimorequityresearch.com.au