Kees Versteeg has been active in the Australian fruit and vegetable sector for sixteen years. He is responsible for marketing and sales at Qualipac, an Australian company that grows, packages and supplies onions and vegetables throughout Australia and abroad. "We export indirectly - via Australian exporters - but since 2014 we have started exporting directly, to countries such as Singapore. We hope to start exporting to Japan this year for the first time."

Right now Qualipac has three types of pumpkins; these are available from December to July. The onion season is over (October to January) and the company is busy with preparations for the broccoli season (April to October). "These preparations are mainly to do with matching our production to meet potential demand. This year the largest percentage of sales will shift from mainly Australia to foreign markets, such as the United Arab Emirates, Singapore and for the first time, Japan. Japan's demand for Australian vegetables has been increasing lately due, in part, to the problematic American vegetable supply caused by, among other things, the drought in California and the problems in American ports," says Kees.

Last onion season was a disappointing one, according to Kees, "The prices for red onions were under pressure due to the many red onions that Australian importers and traders were importing from America. They were not worrying about the income of Australian growers who had sufficient high quality red onions available. Too many red onions were imported from America last year (partly) because the prices of red onions were very good for Australian onion growers. The last batches of American red onions sold for only a few dollars (per 10 kg bag) on the wholesale market, the same wholesale market that received red onions on consignment from their 'own' Australian growers. Because of this, there was little to no demand for Australian red onions and many onion growers in Queensland hit trouble and at the end of the season were forced to either sell under production price or dump them."

Importing onions from the U.S.

Importing onions from the U.S.It frustrates Kees that many of the onions imported from America were sold by local supermarkets and retailers as Australian red onions, thereby taking away the consumer's choice to buy Australian onions and support their own growers. "The red onion season in other growing areas such as Tasmania and Southern Australia, which normally starts January/February and ends around May/June with onions then being put into storage, had a difficult time getting acceptable prices for the red onions due to the last lot of American onions at the beginning of their season which were mostly old and rotten." In Western Australia yellow onions (which are called brown onions in Australia) and mainly red onions were imported from America because they can get them delivered cheaper via sea freight than via trucks from other growing regions in Australia."

"All in all there was very little support from the brokers for the Australian onion growers last season. A lot of it is delivered on consignment, without price guarantee, and for the Australian growers it is usually a matter of crossing their fingers hoping they will have profit. The trade sector takes their margin for each sale and what is left over goes to the grower, but it is not clear what the margin is," continues Kees. "It is therefore not surprising that most of the Australian growers want to supply directly to the supermarkets - to bypass the brokers - to negotiate better prices, but also to actively develop export markets in the hopes of realizing better prices. Wage and production costs are higher in Australia than in America and New Zealand, where many onions are imported from and where the competition is difficult. These onions usually land on the shelves of Australian supermarkets and fruit and vegetable stores under the guise of Australian onions!"

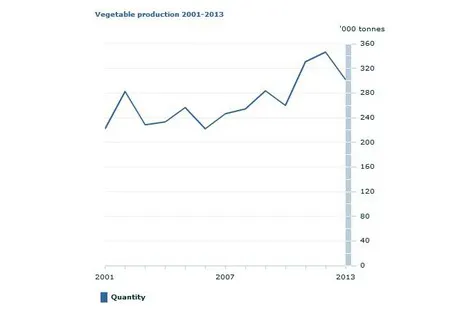

Rising vegetable production

Rising vegetable production

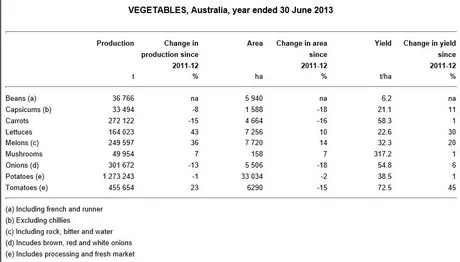

When asked how big the local Australian market is, Kees says: "In regards to the collection of data, Australia is far behind which makes it difficult to form an accurate picture of the size of the market. Growers do not like to work together to form a clear picture of production. Brokers do not share information with the growers, and even supermarkets do not like sharing their information despite their detailed scanning data at the cash registers. If there is data present the correctness of that data is questioned. According to the Australian Office of Statistics, the onion growing area totalled 5,506 acres in 2013 with a total volume of 301,672 tons of onions."

Volume of onions in 2013 was 301,672 tons of onions

Volume of onions in 2013 was 301,672 tons of onions

Australian Retail

The Australian retail landscape is dominated by three large supermarket chains: Woolworths (+/- 39%), Coles (+/- 33.5%) and Aldi (+/- 10.3%) and the independent retailer Independent Grocers Australia (IGA 9.5%). "The fact that the market is dominated by a small number of retailers does not always work in favour of the Australian suppliers. As they regularly have only a few choices they are often put under pressure, despite the rising production costs, to keep the competition going between the supermarket chains," says Kees. " As a vegetable grower we supply both directly and indirectly to supermarket chains, wholesalers, the vegetable processing industry and increasingly abroad. With a larger number of different markets we try to avoid the price being placed under pressure. We create opportunities to deliver to the most profitable customers and markets so that they will have the first pick of our vegetables."

According to Kees, there is a lot of potential in the Asian markets, "Especially if you compare the number of consumers per country with Australia. The biggest obstacle is the higher production costs in Australia, compared to Asian countries. Often, when in talks with potential clients in the Asian market, the price is the first thing mentioned ("You need to be competitive with your price" of "It has to be cheap"). The biggest advantage that we have in Australia is that production occurs under strict rules and regulations in the area of herbicides, protection, hygiene and health and safety. Australia is known for our 'Green and Clean' production of fruits and vegetables, but the price is still the main obstacle. The Australian market is very transparent and wholesale prices fluctuate a lot. The exporting companies here are quite diverse (almost everyone can and wants to export) and even the wholesalers, who receive their fruit and vegetables on consignment from 'their' growers, export and/or supply to exporters, and therefore are competing for the same grower. They also want to develop their own export market to negotiate better prices."