According to the new Global greenhouse update by RaboResearch, several enduring dynamics will influencing decision-making across the protected horticulture sector in 2026. Governments are placing greater emphasis on food security and self-sufficiency, while ongoing developments in climate, technology, and energy could shape both investment strategies and crop selection.

© Rabobank

© Rabobank

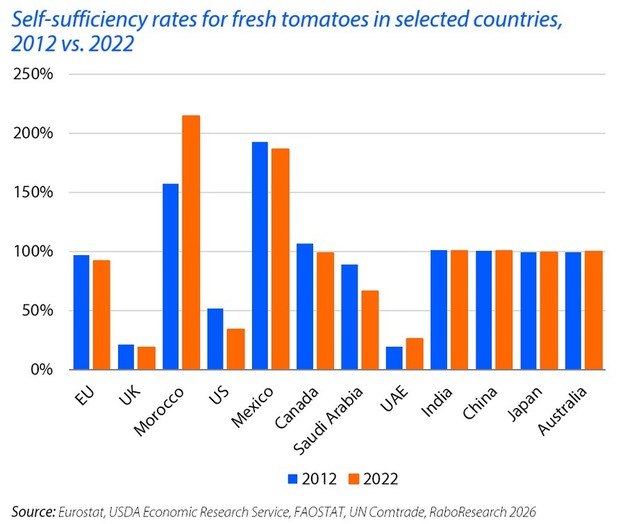

"Governments worldwide have placed greater emphasis on self‑sufficiency, influenced by the Covid‑19 pandemic and ongoing geopolitical tensions," says Lambert van Horen, Senior Specialist in Fresh Produce & Horticulture at RaboResearch. "We expect that over the next decade more countries will gradually approach a higher self‑sufficiency rate for fresh vegetables."

© Rabobank

© Rabobank

Countries across Europe, North America, the Middle East, and parts of Asia are actively reshaping vegetable production strategies. EU and UK self‑sufficiency in fresh tomatoes has declined, for example, reflecting structural dependence on imports. Morocco has sharply surpassed self‑sufficiency, strengthening its competitiveness in European winter markets. And in North America, self‑sufficiency has trended downward, despite stable consumption.

"In the long term, greater self-sufficiency rates will likely result in higher greenhouse investments," adds van Horen.

© Rabobank

© Rabobank

Suppliers limit growth expectations for 2026

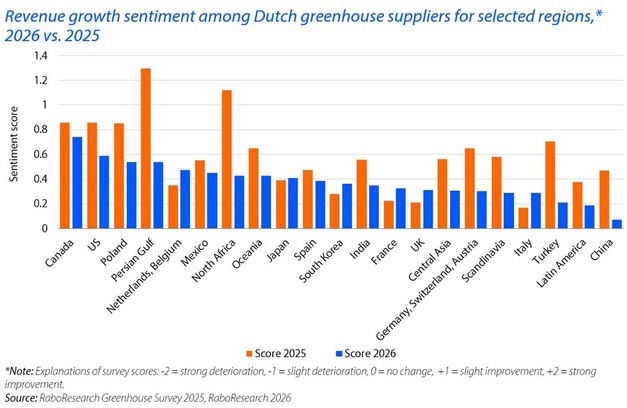

According to a RaboResearch survey, Dutch suppliers of seeds, technology, and greenhouse construction report a more cautious outlook for 2026. While global sentiment remains positive, expectations have weakened compared to 2025.

Sentiment declined most sharply about growth in the Persian Gulf, Turkey, and North Africa, while the Dutch-Belgian market stands out as a relative bright spot.

Growth expected in strawberries and leafy greens

For high-tech horticulture, survey results reveal strong expectations for expanded production of strawberries and leafy greens, with 82% and 74% of respondents expecting area growth in 2026. Tomatoes, cucumbers, and peppers remain dominant but show more moderate growth expectations.

Climate risks may accelerate adaptation

Climate change is affecting protected horticulture at the plant, company, supply chain, and country level. Growers face more frequent extreme weather events, shifting disease pressures, and changing regional suitability.

At the company level, growers are increasingly investing in shade nets, windbreaks, rainwater basins, and more durable structures. At the supply-chain level, climate variability is prompting traders to diversify sourcing regions to reduce exposure.

Data centers and automation offer energy and innovation opportunities

Data centers represent a new potential partner for horticulture. Continuous residual heat from servers – typically 30-40°C – could lower greenhouse energy needs, while supporting renewable energy integration.

Automation is also accelerating, particularly for applications in picking and harvesting. Labor accounts for roughly 30% of cost price in Dutch fruiting vegetable greenhouses, for example, making automation especially attractive. "It makes sense that automation and robotics companies are primarily focused on harvesting and sorting, as these tasks occur daily or weekly during cultivation," van Horen explains.

Regional developments remain diverse

In North America, greenhouse dynamics are shifting in different directions. Canadian production is scaling up, supported by investment in high-tech facilities and a focus on year-round supply. In contrast, the United States is becoming less self-sufficient in several key vegetables, increasing its reliance on imports to meet consumer demand. Mexico continues to strengthen its role as a strategic supplier, backed by a diverse mix of protected cultivation systems that range from shade houses to advanced greenhouse structures.

Across Europe and North Africa, competitive positions are being reshaped. Spain and Morocco are recalibrating their export strategies, each working to defend or expand market share in core European destinations. At the same time, the Netherlands is seeing ongoing consolidation among producers, as scale, energy efficiency, and access to capital become increasingly important for long-term viability.

In Asia, China remains the central driver of expansion. The country continues to scale protected cultivation across low-, mid-, and high-tech systems, responding to food security priorities and shifting consumer expectations. Over the past 12 years, China's protected cultivation area has more than doubled and is now estimated at 1.3 million hectares, reinforcing its position as a dominant force in the global greenhouse landscape.

"Overall, 2026 marks a period in which self-sufficiency, the energy transition, technological adoption, and climate pressure converge, creating both challenges and new avenues for innovation and growth for the global greenhouse industry," van Horen concludes.

You can download the full report at the link here.

For more information:

Rabobank![]()

rabobank.com/