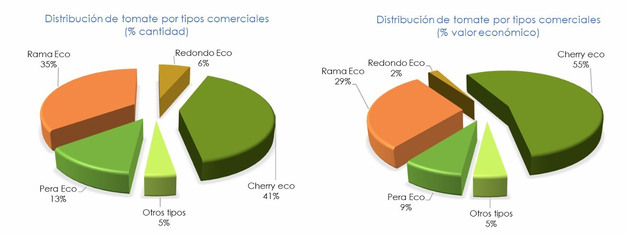

According to 2024/25 data provided by companies collaborating with the Prices and Markets Observatory, tomatoes lead organic production in Andalusia, accounting for 30% of the marketed organic output of the main greenhouse vegetables and 35% of total economic value. Within this segment, cherry tomatoes are by far the most significant category.

© Hwongcc | Dreamstime

© Hwongcc | Dreamstime

During the 2024/25 season, cherry tomatoes represented 55% of the economic value received by growers, with 41% of the marketed organic tomato volume.

© Observatorio de precios y mercados de la Junta de Andalucía

© Observatorio de precios y mercados de la Junta de Andalucía

Farm-gate prices

The average farm-gate price for organic cherry tomatoes reached €1.66/kg in 2024/25, €0.06 higher than in the previous season. At the same time, marketed volumes increased by 4%, according to data from companies collaborating with the Prices and Markets Observatory. This marks the highest price level recorded over the past 3 campaigns, although quotations remain relatively stable for a product with a well-established market.

© Observatorio de precios y mercados de la Junta de Andalucía

© Observatorio de precios y mercados de la Junta de Andalucía

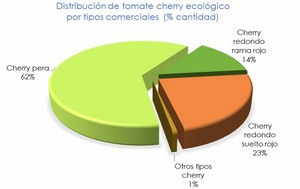

Pear-shaped cherry tomatoes dominate organic production, accounting for 62% of total volume, followed by loose round cherry tomatoes with a 23% share. In 2024/25, marketed volumes of pear-shaped cherry tomatoes increased by 25%, continuing a multi-year trend that reflects market preference for sweeter, more flavourful varieties. However, this was the only cherry type to record growth, as supply of all other segments declined by just under 20%.

From a phytosanitary perspective, the general rise in temperatures has intensified pest pressure, particularly whitefly and red spider mite, over the past 2 campaigns. In tomatoes, special attention continues to be paid to Tomato Brown Rugose Fruit Virus (ToBRFV), a contact-transmitted virus. Thanks to the widespread adoption of new cherry tomato varieties with resistance, the economic impact of the virus has been significantly reduced.

According to the Observatory's report, Morocco has also recorded a strong expansion of ToBRFV in Agadir (Souss-Massa-Draa region) and Dakhla (Western Sahara), the country's main greenhouse tomato production areas.

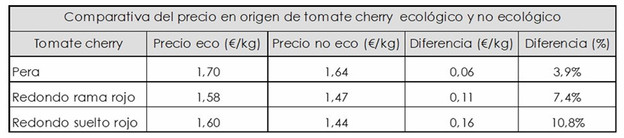

As for the average organic–conventional price gap, margins remain very tight in the cherry tomato segment. In vine cherry and pear-shaped cherry tomatoes, organic–conventional differentials stand at 7% and 4%, respectively. Loose round cherry tomatoes show the widest gap, with an 11% price differential.

© Observatorio de precios y mercados de la Junta de Andalucía

© Observatorio de precios y mercados de la Junta de Andalucía

Challenges for Spain's organic cherry tomato sector

Organic cherry tomato production in Spain is facing significant challenges on both the production and marketing fronts. On the commercial side, the strong push by European supermarkets to expand their organic ranges, often alongside conventional offerings, is putting downward pressure on organic prices in an effort to narrow the gap between the 2 categories. Particularly notable is the increase in organic cherry tomato availability in discount retail formats. Competition from third countries is also weighing on the market, especially the expansion of Moroccan cherry tomato production, a labor-intensive crop that benefits from significantly lower wage costs and greater labor availability.

On the production side, the more limited range of tools available for pest, disease and virus control in organic systems increases losses when outbreaks occur. Combined with rising production costs, which are already higher in organic farming, this is discouraging organic production relative to conventional systems. As a result, part of the sector is "migrating" back to non-organic production, leading to a stabilization of the conversion rate.

Source: juntadeandalucia.es