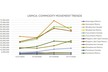

Over the past decade, Morocco's tomato exports to the EU have increased significantly. From 2015/2016 to 2024/2025, Morocco went from selling less than Almeria and Spain to surpassing Almeria and now surpassing Spain's total exports, according to an analysis by Hortoinfo based on Estacom and Euroestacom data.

Almería, Spain's top tomato exporter, experienced a 28.16% decline in EU sales, dropping from 497. 61 million kilos in 2015/2016 to 357.49 million kilos in 2024/2025. Despite this decrease in volume, export value increased from €451.44 million to €566.81 million, driven by a higher average price of €1.59 per kilo, up from €0.91.

Murcia saw a 29.5% decrease in volume, from 65.99 million to 46.52 million kilos, but its export value rose from €58. 97 million to €73.63 million, with an average price of €1.58 per kilo. Granada experienced the most significant decline in volume (-48 52%), dropping from 76.8 million to 39. 54 million kilos. However, its export value decreased by only 28.9% due to an increase in the average price from €1.95 to €2.7 per kilo.

These three provinces account for most of Spain's exports: Almería, 68.77%; Murcia, 8.95%; and Granada, 7.61%. Overall, Spain reduced its tomato exports to the EU by 33.42%, from 780.8 million kilos in 2015/2016 to 519.83 million in 2024/2025. However, the total value increased from €800 million to €888.43 million, with an average price of €1.71 per kilo.

Meanwhile, Morocco's sales increased by 41.39%, from 406.36 million kilos in 2015/2016 to 574.54 million in 2024/2025. Almería was the leading exporter until the 2018/2019 season, when Morocco sold 469.63 million kilos, surpassing Almería's 428.21 million kilos.

In the 2022/2023 season, Morocco surpassed Spanish tomato exports to the EU, with 544.08 million kilos compared to Spain's 525.62 million. Spain temporarily regained the lead in 2023/2024, but lost it again in 2024/2025, as Morocco finished that season with 574.54 million kilos, while Spain ended with 519.83 million.

Source: hortoinfo.es