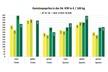

"According to forecasts drawn up on November 1st 2025, French tomato production for the fresh market is estimated at 497,600 tons for the 2025 season, which is 11,100 tons less than in 2024 (-2%). In October 2025, prices were 24% lower than in the 2024 season and 19% lower than the 2020-2024 average for the same month, with little active demand," according to the Agreste economic outlook.

Greenhouse production down year-on-year

The greenhouse area for the fresh market in 2025 is expected to be slightly down year-on-year (-1%), at 2,758 hectares (but 2% higher than the 2020-2024 average). French production is estimated at 497,600 tons, which is 2% less than in 2024. The decline is most marked in the Center-West and West regions (down by 6% from 2024). On the other hand, production in the Southwest basin is up (+7%) thanks to higher yields.

"The drop in national production is attributable to greenhouse production (down by 3% year-on-year), slightly offset by an increase in field production (up by 2% year-on-year) with higher yields."

French production dropped sharply from September onwards, but supplies remain plentiful," according to Agreste.

End-of-season prices down on previous years

"In September, trade slowed down, with a drop in both demand and supply. Prices also fell, particularly for small fruit (down by 15% year-on-year and down by 19% on the 2020-2024 average for the same month), due to stiff competition from Moroccan production. The market remains relatively balanced for large fruit. The situation for small fruit improved in October, but the market was not very dynamic for large fruit (prices down by 30% year-on-year and 24% below the 2020-2024 average for the same month), with volumes still substantial and consumption lacking dynamism."

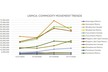

Between January and September 2025, and compared with the same period in the previous marketing year, tomato exports (199,400 tons), including significant volumes of re-exports, were down by 12% and imports (388,800 tons) by 8%. The foreign trade deficit in volume terms (189,400 tons) fell by 4% year-on-year during the period under review.

Source: Agreste