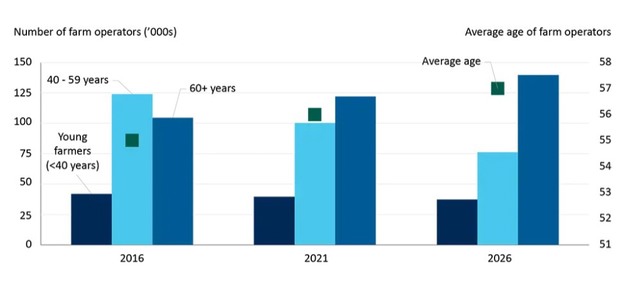

Canadian agriculture is facing a major challenge, as sweeping demographic changes drive a generational transfer of farm assets that will define the sector's future. The makeup of the farming population is shifting. By 2026, more than half of Canada's farm operators are expected to be over the age of 60, while the number of young growers under 40 is projected to remain stagnant (Figure 1). The average age of farm operators continues to rise — from 55 in 2016 to a projected 57 in 2026. Farm exits are outpacing new entries, with an average of 3,500 farm exits through closure or consolidation into corporate family farms each year between 1996 and 2021.

© Statistics Canada, FCCFigure 1: Age demographics of Canadian farm operators — 2016, 2021 and FCC 2026 projections

© Statistics Canada, FCCFigure 1: Age demographics of Canadian farm operators — 2016, 2021 and FCC 2026 projections

The industry faces an unprecedented transfer of farm ownership, with over $50 billion in farm assets set to change hands over the next decade. This assumes that farm exit rates remain similar to the most recent census trend (2016 to 2021) of two per cent or 0.4 per cent per year. This translates into an estimated $40 billion in farmland (approximately 5.4 million acres) and $10 billion in current assets, which includes machinery, buildings, and other non-land assets by the end of 2035.

Note that an unlikely return to the higher long-term average exit rate of 0.8 per cent annually would generate much larger asset transfers. The rise of family corporation farms partly explains the recent lower exit rates and impacts how asset transfers occur. The proportion of farm assets shifting to the next generation within these family corporation farms will remain strong. This observation combined with one to three percent of farmland changing hands each year supports a higher level of asset transfers over the next decade than the estimated $50B. As such, the latter estimate is a lower bound to overall asset transfers; and there's a much higher upper bound for asset transfers that is difficult to estimate.

Given the demographic trend and required farm asset transfers, a critical question arises: how can Canadian agriculture successfully bridge the generational gap and secure a promising future of farming? The answer lies with a new generation of growers — young, diverse, highly educated, ambitious, and ready to lead. But their path is anything but easy; elevated land prices, limited access to capital, and complex succession planning are all barriers that must be overcome.

© FCC

© FCC

Overcoming hurdles to growing

Inherent production risks in agriculture and financial risks are considerable barriers for young growers. For those without family farming backgrounds or industry connections, these challenges can be acute. The rising value of farmland is a significant financial barrier because farm income trends have lagged asset values in the last ten years, making farmland ownership increasingly difficult. New entrants can access farmland through cash rental arrangements or crop-share arrangements. The cost to rent farmland is generally lower than financing a purchase, and can also alleviate cash flow constraints and help managing financial risk.

Young growers can also have knowledge and skills gaps. Modern farming demands expertise in areas like advanced farm management skills (advanced agronomics, precision agriculture, smart farming, vertical farming, biotechnology etc.), financial management, regulatory compliance, and sustainability — which can be daunting to acquire, especially for those without prior exposure to agriculture. The one-cycle-per-year nature of farming also means that learning through experience can be costly. Young growers often lack access to established networks and mentorship, leaving them isolated and without industry insights and support.

Opportunities to empower young growers

To build a vibrant future and attract young growers it is imperative to expand access to capital and land. Support tailored loans, grants, and land-matching programs (e.g., British Columbia's Land Matching Program) to help young growers to secure financing and farmland. Succession planning resources are essential; Leverage dedicated capital solutions (e.g. FCC Transition Loan); Invest in education and mentorship. Youth programs (e.g., 4H and Agriculture in the Classroom), scholarships, hands-on training, advisory services (e.g., FCC let's talk transition) and peer networks (e.g., Young Agrarians) build skills and facilitate knowledge transfer; Promote the sector with public campaigns that can modernize agriculture's image and attract diverse talent; and strengthen rural communities. Invest in rural infrastructure and services to make rural communities more appealing and inclusive, especially for underserved groups.

The future of Canadian agriculture depends on empowering the next generation by breaking down barriers and building more inclusive pathways into the sector. Canada can ensure that its farms, food supply, and rural communities thrive for generations by harnessing the energy, creativity, and diversity of young growers.

Source: FCC