The upcoming season for Moroccan raspberries begins in the coming weeks. The sector is enjoying a period of stability, or at worst, positive stagnation. The acreage has remained unchanged for several seasons, and issues related to climate and labor are becoming increasingly pressing. On the other hand, demand is strong, and growers are achieving enhanced yields. This is according to Amine Bennani, president of the Moroccan Association of Soft Fruit Growers.

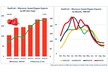

The acreage devoted to raspberry growing has remained stable over the last two or three seasons, in line with market demand in terms of volume. Bennani explains: "Over the last few seasons, we have been working on around 4,600 to 4,800 hectares spread across the Loukkos and Souss Massa regions and their respective main production sites, Larache and Agadir. I don't think there will be any change for the coming season, as this area corresponds to market needs, i.e., a production of 64,000 to 68,000 tons in 2024/2025, including 35 thousand tonnes in Souss Massa and 29 thousand tonnes in the Loukkos region."

© Moroccan Association of Soft Fruit

© Moroccan Association of Soft Fruit

Despite stable acreage, growers are managing to achieve higher yields. Bennani adds, "If we compare the past season's results (2024/2025) with the previous one (2023/2024), production increased by 14%, from 56,280 tons to 64,000 tons. This is indeed a nice performance, despite being characterized by irregular harvests due to an increasingly challenging climate."

In commercial terms, Moroccan raspberry exports performed well, according to Bennani, particularly on the European market. He adds: "The main destination for Moroccan raspberries remains Europe. The UK market was our top destination in 2024/2025 with 19,979 tons, followed by Spain with 18,378 tons, Germany with 16,860 tons, the Netherlands with 8,954 tons, and France with 6,989 tons. Morocco also exported to other countries such as Italy, Portugal, Tunisia, Jordan, and the Gulf countries, with quantities below 1,000 tons. Moroccan origin is the most present in certain markets such as the Middle East, but these volumes remain insignificant compared to total exports."

For the upcoming season, which begins in the coming days, the climate challenge is becoming more pressing with sharp temperature swings and intense heat waves this summer. Bennani comments, "It's still too early to say what next season will bring. The specter of climate change looms in the form of adverse weather or water shortages, and the plants are indeed stressed, but growers are managing their operations as best they can, and we hope to at least stabilize production if we can't achieve an increase in volume. In fact, despite last year's increase in production, harvests were irregular and there were no raspberries available at times of the season when they should have been."

According to the growers' representative, the climate challenge is compounded by another major issue, namely the labor shortage that particularly affects the red fruit sector, including raspberries. He concludes: "We are also seeing the emergence of another challenge, this time at the commercial level, with the rise of 'one-shot' exports. These are export operations that seize opportunities arising from shortages in certain markets and are therefore characterized by small quantities and high prices. In themselves, these exports are a good thing, as they can serve as commercial trials in certain markets and pave the way for business development, but they have negative side effects, such as creating tensions between growers and exporters over average weekly prices, and also raise regulatory compliance issues, such as varietal licenses and contractual commitments to established customers."

For more information:

Amine Bennani

Moroccan Association of Soft Fruit Growers

Tel: +212661243424

Email: [email protected]