The industry is still on solid footing, especially compared to pre-pandemic years, but the explosive growth of 2020–2021 has settled into a more moderate pace. That's in short what Charlie Hall shared during his keynote speech of Cultivate 2025. The PhD, Chief Economist at AmericanHort, explained economic headwinds like tariffs, inflation, and uneven regional demand are real, but they're not derailing the market. And there are positive signs: Consumer engagement remains strong—new gardeners and buyers are largely staying active, giving the sector a stable base. Success now hinges on efficiency, automation, and value-driven positioning, rather than simply riding demand waves.

© AmericanHort

© AmericanHort

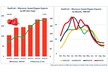

At the opening of Cultivate in Columbus, Ohio, Charlie Hall, PhD, Chief Economist at AmericanHort, provided an overview of current horticulture industry performance, supply chain conditions, and broader economic indicators. Charlie began with results from the "Your Market Metrics" program, which gathers input from growers ahead of Cultivate. The dataset represented approximately USD 3 billion in sales from January through June.

According to Charlie, 78% of respondents reported higher year-over-year sales for the first half of 2024, while 22% reported declines. He cautioned that year-over-year comparisons should be assessed in the context of multi-year averages, noting that strong results in 2023 could make this year's comparisons appear weaker.

Compared to pre-pandemic 2019 levels, 98% of growers said sales were still higher, with 69% reporting increases of more than 25%.

Profitability results were more varied. While 74% of respondents indicated higher net profits than in 2023, responses were spread across a range of performance categories, without the bell-shaped curve seen in the sales data. Unit sales were split evenly, with 50% reporting increases and 50% reporting declines.

Charlie also identified a subset of growers achieving higher sales, profits, and units simultaneously, as well as a smaller group with declines across all three metrics.

Retail sector trends

Data from Danny Summers and Tim Quibido, as well as from the Your Market Metrics retail tracking, showed a mixed picture at the consumer level. Across participating garden centers, revenue was up 0.3% year-to-date, the average transaction value increased 1.7%, but transaction counts declined by 1.4%. Customer counts were down 0.5% year-to-date and down 3% versus the three-year average.

Regional performance varied, with weather patterns influencing sales. Charlie noted ongoing drought in some areas and excess rainfall in others. Performance across major national retail chains was also uneven. Publicly available sales data showed two of the three largest home improvement and mass retail chains with year-over-year gains, while one recorded a decline.

Charlie said pandemic-era growth in the lawn and garden category within big box retail has slowed to what he described as "glacial" rates, with uneven year-to-year results. However, he noted that most of the estimated 18–20 million new category consumers from the pandemic period continue to participate, a pattern not typically seen after past economic downturns.

Industry growth trajectory

Using U.S. Census data for flowers, seeds, and potted plants from 2006 to 2024, Charlie illustrated three phases: slow growth before the pandemic, a marked lift during the pandemic, and a plateau in recent years. Early 2024 data showed modest growth in the 1–3% range compared to 2023, remaining above 2019 levels.

Macroeconomic context

Charlie then shifted to national economic conditions. U.S. GDP declined 0.5% in the first quarter of 2024, triggering media discussion of potential recession. However, he pointed to the "sales to final domestic purchasers" metric—which removes government spending, inventory changes, and net exports—as a more accurate measure of domestic economic activity. This metric was growing at 1.9% in Q1, suggesting continued moderate expansion.

Economic performance by state showed wide variation, with some regions outperforming and others lagging.

Supply chain and tariffs

Charlie discussed potential impacts of new and proposed U.S. tariffs. While global supply chain pressure indices remain stable for now, container shipping rates from Asia have been volatile. He said the industry's pandemic-era diversification of suppliers and contingency planning would be useful during tariff-related disruptions.

He described tariffs as a "blunt instrument" that can generate government revenue but also disrupt established cross-border supply chains built over decades. The net effective tariff rate, averaging announced measures, is currently about 14%, though the degree to which these costs will pass through to consumers is uncertain. Exporting countries may lower prices to offset tariffs, importers may absorb some costs, and the remainder could flow through the supply chain.

Charlie forecast that tariffs at current levels could raise input costs for growers by 5.2% in 2026; if all proposed tariffs were implemented, the increase could reach 9.4%. If adverse effect wage rate reforms were successful, these increases could be reduced to 3.0% and 7.2%, respectively.

Inflation and monetary policy

The U.S. core Personal Consumption Expenditures (PCE) inflation rate, excluding food and energy, is currently 2.6%, with headline PCE at 2.3%. Charlie said the inflationary effects of tariffs have not yet appeared because many businesses are selling from existing inventories purchased at pre-tariff prices. These effects are expected to emerge as inventories are replenished.

The Federal Reserve is expected to keep interest rates steady until its September meeting, pending more data on inflationary impacts.

Housing sector

Although housing market slides were omitted from this year's presentation, Charlie noted that mortgage rates of around 6.7% remain a headwind. A reduction toward 5.5–6.0% could trigger increased home purchases, which in turn would drive demand for landscaping and plants.

Recession outlook

Charlie reviewed six indicators from his "recession dashboard." Five—including unemployment claims, the St. Louis Fed's risk index, the Chicago Fed's national activity index, the yield curve, and the Sahm Rule recession indicator—are not signaling recession. Only the Conference Board's Leading Economic Index is in recession territory, which would point to potential downturns 11–12 months ahead.

He estimated the current probability of recession at 20–40%, depending on the economic effects of the "One Big Beautiful Budget Act" and tariff responses.

Takeaways for growers and suppliers

Charlie concluded with several recommendations for greenhouse businesses:

Avoid overreacting to short-term year-over-year comparisons and monitor multi-year averages.

Manage working capital closely.

Conduct customer analytics and SKU rationalization.

Maintain a clear value proposition.

Be agile and prepared with contingency plans.

Manage key relationships in the supply chain.

He also urged businesses to understand and utilize the potential tax and investment incentives within current legislation while preparing for possible longer-term cost impacts.

Want more Cultivate 2025?

Click here for the photo report of the floricultural companies