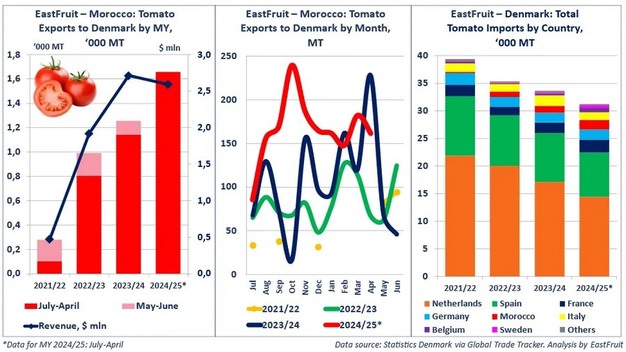

Morocco is steadily increasing its share in the Danish fresh produce market, with continued growth in exports of fresh or chilled tomatoes, according to EastFruit. Moroccan tomato exports to Denmark reached 1,660 metric tons during the first 10 months of the current marketing year (July 2024 – June 2025), up 32% from MY 2023/24 and 67% from MY 2022/23. Over the past three marketing years, Morocco's shipments to Denmark have grown nearly sixfold.

Tomatoes are Morocco's top fruit and vegetable export, representing more than 25% of the sector's foreign currency earnings. While Denmark is not one of the main destinations for Moroccan tomatoes, in contrast to France, the United Kingdom, and the Netherlands, its share in Morocco's total tomato exports remains below 1%. The upward trend, however, points to Denmark becoming a growing outlet within Morocco's broader plan to diversify export destinations.

Moroccan tomatoes have been shipped to Denmark each month over the past three marketing years, without clear seasonal peaks. In MY 2022/23, the highest volumes were recorded in February, while in MY 2023/24, the peak occurred in April. October was the lowest export month in MY 2023/24, yet in the current MY, October volumes reached a record high.

The Netherlands and Spain remain Denmark's leading tomato suppliers, but their export volumes and Denmark's total tomato imports have been declining in recent years. Morocco's market share, on the other hand, is increasing. In MY 2021/22, Moroccan tomatoes made up less than 1% of Denmark's imports; by MY 2023/24, the share had risen to 3.7%. After the first 10 months of the current MY, it now exceeds 5%. Morocco's main competitors in Denmark include France, Germany, and Italy. Current data suggests Morocco could overtake Italy in volume and enter Denmark's top five tomato suppliers for the first time.

For the past two marketing years, Morocco has been the only non-European country supplying tomatoes to Denmark. In addition to Denmark, Morocco also set a new record for tomato exports to Norway in the current MY, underlining the role of Scandinavian countries in Morocco's export strategy. Morocco's exports to Denmark are not limited to tomatoes. Other products include pickled and canned vegetables, watermelons, almonds, and, starting this marketing year, strawberries.

Source: EastFruit