The U.S. Commerce Department's termination of the Tomato Suspension Agreement on July 14, 2025, has ignited a new chapter in the decades-old trade dispute over Mexican tomato imports. With tariffs now set at 20.9%, the move aims to shield domestic growers from alleged "dumping" but has instead sparked a heated clash between agricultural interests, retailers, and consumers. For investors, this policy shift presents a microcosm of broader inflationary and supply chain risks—particularly in sectors reliant on perishable goods. Here's how to navigate the fallout.

The tariffs are expected to push tomato prices up by 10% in the coming months, according to analyses by experts like Timothy Richards of Arizona State University. This surge will disproportionately impact restaurants, grocery chains, and households.

The ripple effects are already visible. Fast-food chains like Darden Restaurants (DRI), which relies heavily on tomatoes for dishes like sandwiches and salads, face margin squeezes. Similarly, grocers like Kroger (KR) and Walmart (WMT) may see higher inventory costs, squeezing profits unless they pass expenses to consumers—a move that could further deter shoppers in a cost-conscious economy.

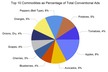

Mexican tomatoes account for roughly 60% of U.S. imports during off-seasons, making them a critical supply chain link for restaurants and retailers.

Read more at AInvest