Egypt and Morocco are the primary beneficiaries of the UK’s withdrawal from the EU within the horticultural sector, with both experiencing a significant surge in exports to the British market over the past five years, according to EastFruit.

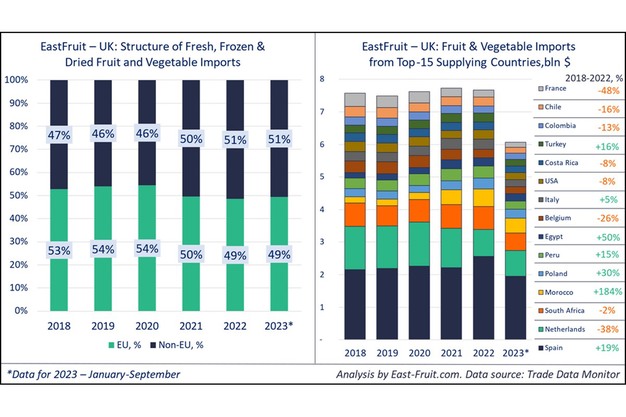

The enactment of Brexit in 2020 resulted in more intricate import protocols for products originating from EU member states, encompassing fruits and vegetables. Consequently, British importers have progressively shifted their focus to procurements from countries outside the EU. This strategic realignment has led to an increase in the proportion of non-EU imports within the UK’s market structure, rising from 47% to 51% by 2022, a ratio that has been maintained into the current year.

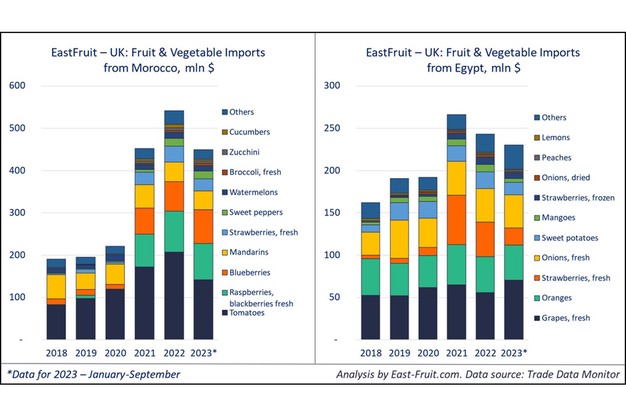

The period of 2022-2023 witnessed severe food inflation within the UK, which, coupled with the complexities of import procedures, precipitated a decline in supplies from numerous non-European nations. This scenario prompted a comprehensive transformation in the UK’s vegetable and fruit market, particularly in the composition of its supplier base. Notably, Egypt and Morocco have demonstrated the most substantial growth in their export volumes to the UK.

The period of 2022-2023 witnessed severe food inflation within the UK, which, coupled with the complexities of import procedures, precipitated a decline in supplies from numerous non-European nations. This scenario prompted a comprehensive transformation in the UK’s vegetable and fruit market, particularly in the composition of its supplier base. Notably, Egypt and Morocco have demonstrated the most substantial growth in their export volumes to the UK.

From 2018 to 2022, the UK’s importation of fresh, dried, and frozen Egyptian produce expanded by 150%, while Moroccan goods saw an almost threefold increase. In contrast, imports from traditional European suppliers such as the Netherlands, Belgium, and France experienced a marked decrease, with French imports halving over the same five-year span.

Interestingly, Poland, despite being an EU member, managed to bolster its market share in the UK, with imports of Polish fruits and vegetables increasing by 33% over five years. Similarly, Spanish exports to the UK also rose in 2022, a reflection of escalating produce prices due to climatic upheavals and other adverse events in 2022-2023. Prior to these developments, Spain’s export figures had remained relatively stable.

For more information: east-fruit.com