Swiss farmers are heavily supported by taxpayers. In addition to higher taxes, Swiss consumers must also dig deep to cover the import tariffs built into some food prices. In 2020, an average household spent around 10% of their income on food, including restaurant meals, according to the Federal Statistical Office.

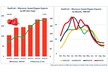

During Switzerland’s cherry tomato harvest season, which runs from May to October, the import tariff on tomatoes is CHF 731 per 100 kilograms. This means a 500g box of cherry tomatoes comes with a surcharge of CHF 3.66. Other vegetables with high tariffs include carrots (CHF 710 per 100kg) and strawberries (CHF 510 per 100kg).

Producing food in Switzerland is essentially uneconomic. If Swiss farmers were forced to face the market, their businesses would fail fast. Without taxpayer support, they would need to price products at prices few would pay. And without tariffs, relatively lower-priced imports would leave Swiss farmers with few customers. Farmers’ very existence largely depends on taxpayer largess and consumers paying artificially inflated prices.

Direct public payments to Swiss farmers total around CHF 3 billion a year. This comes out at around CHF 1,400 per household a year, assuming a household is made up of two parents and two children.

[ CHF 1 = €1.04 ]

Source: lenews.ch