Every four years, the Purdue University Center for Food and Agricultural Business conducts the Large Commercial Producer (LCP) survey, which collects data from approximately 2,000 farmers across the U.S. This survey has consistently shown that farmers behave differently when buying different inputs, meaning suppliers should be cognizant of these factors when designing their go-to-market strategies.

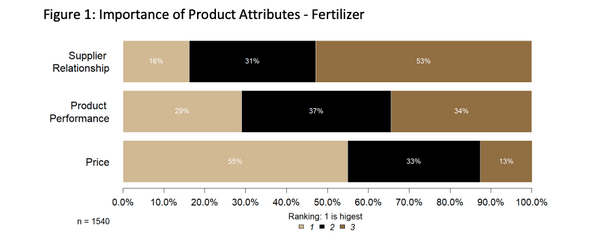

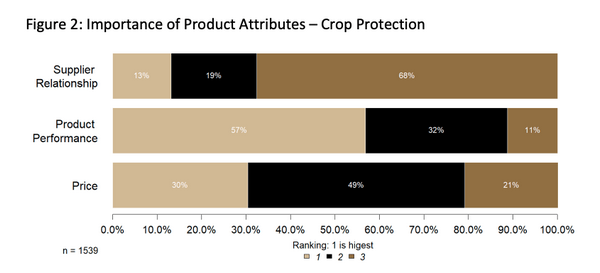

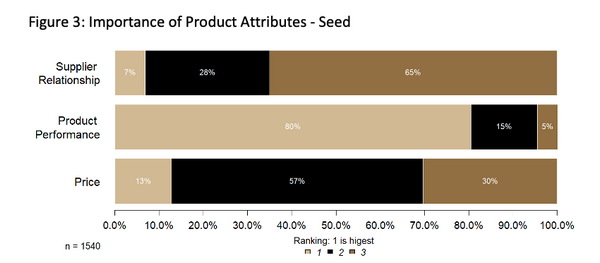

One area of the LCP survey explores farmers’ purchasing behaviors. More specifically, it explores the different levels of importance farmers place on (a) supplier relationships, (b) product performance, and (c) price when making decisions around fertilizer, crop protection, and seed. The results can be seen in the figures below.

As shown in the graphs, 55% of farmers ranked price as the most important when evaluating fertilizer, product performance fell as the second most important (29%), and supplier relationships ranked third (16%).

In terms of crop protection, the order of importance changes. Instead of price, product performance stood as the most important (57%), followed by price (30%) and, finally, supplier relationships (13%).

In the seed category, product performance ranked as the most important, with a much higher ranking in comparison to crop protection (80%). Price came in second place (13%), and supplier relationships ranked as clear third (7%).

These numbers bring about potentially interesting conclusions and cause us to consider further questions. While farmers seem to make decisions almost solely based on price when thinking about fertilizer, the importance of product performance is extremely important to them when it comes to crop protection, and even more so for seed. The perceived level of product differentiation may be behind these differences. For example, if farmers see variability in seed performance, this may impact the profitability of their crops, making it important for them to place a heavy emphasis on product performance. Another factor that may have impacted these results lies in the recent increase in the cost of seed relative to total crop production costs.

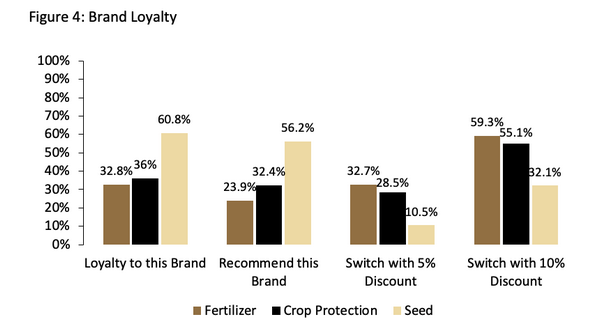

Looking further into farmer purchasing behaviors, the LCP survey explored brand loyalty. Farmers were asked if they consider themselves loyal to a brand, if they would recommend it, and if they would switch brands for a 5% or 10% discount. The results are shown below. Similar to the discussion on purchasing criteria, farmers ranked brand loyalty levels for fertilizer, crop protection, and seed categories.

As the graph shows, farmers are least loyal in the fertilizer category and most willing to change from a brand if there is a discount. When offered a small discount, farmers in fertilizer and crop protection can be easily swayed to change from one brand to another; however, the seed is drastically different. A high 60% of farmers said they consider themselves loyal to a seed brand, and 56% say the brand they use is their main choice. When it comes to seed, only 10% of farmers will switch from their main brand when offered a discount of 5%.

Understanding the customers’ purchasing criteria and brand loyalty is of paramount importance when designing marketing strategies. Because betting on low prices and best quality products are almost always contradictory, companies must make their choice between which option they want to harness.

For example, many fertilizer companies may attempt to offer competitive prices as they know this is an important aspect for farmers, while others may try to harness the power of differentiation in an attempt to appeal to the fewer farmers who value product differentiation.

The above scenario would likely be the opposite for seed companies, as most of them would be spending time strengthening the attributes that make their products different from competitors, as they know this is important to farmers in the seed category. Other seed companies may focus less on differentiation and instead offer a decent product at a much lower price.

Ag retailers have a long history of serving farmers’ needs in the areas of crop protection, fertilizer, and seed, as well as services such as custom applications or advice based on data collected from farms. Likewise, input manufacturers have increasingly brought integrated offers to farmers that combine crop protection and seeds. Both ag retailers and input manufacturers tend to favor these more complete solutions for farmers and like to sell bundles that are frequently positioned as a “package of benefits.”

These bundle offers should be used with caution when thinking about how different products are perceived by farmers. For example, taking advantage of a farmer’s loyalty to their seed product to push sales of crop protection and/or fertilizer in one package may be perceived by farmers as opportunistic and detrimental to trust building.

In general, seed suppliers have the greatest challenge in displacing well-positioned competitors and must work closely with farmers to show evidence that changing brands will indeed impact farmer success. To do so, they often offer the classic “try before you buy” initiative to instigate change. On the other hand, crop protection and fertilizer companies can utilize more commercial initiatives, such as sales campaigns, to conquer space in a more volatile marketplace.

Of course, there are many facets to be considered when analyzing this data, such as different crops, acreage, farmer educational level, and age. There are certainly opportunities to be sharper in the design of marketing strategies if we can effectively define our target segment and truly understand farmer loyalty to brands, as well as what criteria farmers use to decide on one brand over another.

Source: agribusiness.purdue.edu