International berry trade has grown tremendously over the last few years. Berry breeding has made major steps forward, and the consumer appetite for berries seems unstoppable. For the berry industry, a focus on quality is of utmost importance to retain consumers’ strong appetite for berries. At the same time, businesses need robustness to cope with challenges like growing competition, increasing costs, and labor issues. The latest edition of the Global Berry Congress (GBC), which has been held since before the berry boom in Europe really took off, highlighted five main themes, which are discussed below.

The unstoppable consumer appetite for berries

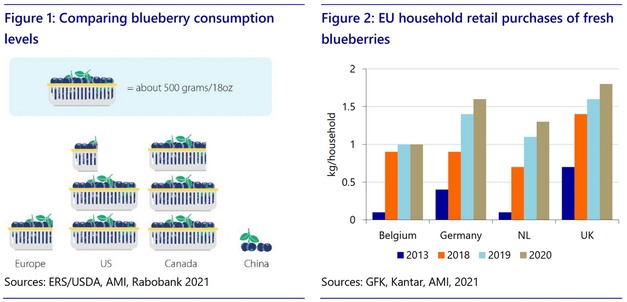

One satisfying recurring topic in the speeches at the various GBC editions is the continuing firm market growth (potential) for berries, in particular blueberries. Per capita consumption levels vary significantly around the world, even within markets like the EU, which is often designated as mature (Figures 1 and 2), not to mention Asia, where consumption has hardly taken off. There are several factors that will drive further consumption in berries: increasing availability, improved quality and consistency, growing health consciousness, and the ongoing preference for convenience and affordability.

Blueberry expansion and flattening prices

Blueberry supply in the EU market has continued to expand in recent years (see Figure 3). Also, the US market has absorbed increasing supplies of blueberries. A trend observed in both North America and Europe is the flattening of price levels for blueberries. In Europe, this is particularly the case during the overseas season (September-March) and in the US mainly during the months June-August and October-March. Upcoming exporters like Morocco, Mexico, and Peru have driven supplies off-season. For the coming years, further expansion in global blueberry supplies is expected, along with flattening prices, as investments in blueberry plantings have not ended yet and recent plantings have not reached their full production capacity. The potential upside of lower price levels is that this will encourage consumption. Increased availability will result in larger and lower-priced package sizes. This was already seen in the US at the peak of arrivals from Chile, and in Germany during supply peaks (see Figure 4). A positive side effect of this trend is a reduction in the use of plastic.

Unwrapping the packaging challenge

The intense use of plastic packaging is one of the other much-debated, but less happy topics in the global berry industry. Spain and France have recently announced a ban on (consumer size) fresh produce packaging. Delicate products like berries are still excluded from this, but according to the buzz at the GBC, it is only a matter of time before other countries follow in implementing stricter regulations, although this is easier said than done. Delicate perishable products, like berries, just cannot travel without packaging, and alternatives like cardboard packaging still have various disadvantages compared to plastic packaging. Potential disadvantages are related to convenience, shelf life, food safety, visibility, durability, and costs. Still, many companies are working hard to recycle and reduce plastic. Some exporters, for example, ship blueberries in bulk (for example a 3kg single box) to re-pack at destination in accordance with local customer specifications.

Availability and costs of labor, other inputs, and logistics

Issues related to rising costs are not restricted to packaging only. Various other cost factors in production and distribution, including energy, labor, transportation, and fertilizers, have skyrocketed recently. In the case of labor, the lack of it is even more of a concern than just the rise in costs. Increasingly, the lack of people willing or available to work in the berry sector is a global issue. Companies use different strategies to manage this: some move to differentiating more premium varieties, while others move to higher-yield varieties. Others are increasing the share of mechanically-harvested blueberries, therefore selling more berries for the frozen processing industry. Various large players have invested in or partnered with developers of harvesting robots. Strawberry growers in Europe are increasingly moving towards (covered) table top production systems in order to increase labor productivity. Also, in North America, there are increasing investments in strawberry production in controlled environments such as glasshouses. This increases labor productivity and allows more local production. Particularly for strawberries, locality is a trend, but it comes at a cost.

The various cost increases will either result in lower margins for growers or higher retail prices for berries. One of the questions raised during the GBC is whether higher prices will impact berry consumption. Opinions on this differ. Some industry players believe that consumers might move away from berries towards more affordable fruits like apples and bananas. Some believe that flavor, snackability, and healthy attributes will continue to drive the consumption growth of berries, despite potential price increases.

Nothing but quality

The solution to many (though not all) of these challenges is quality. The industry unanimously agrees on the importance of quality and consistency in berries supplied. A market survey by Normec Foodcare on the consumer quality perception of blueberries shows that only one out of three shoppers buying blueberries in the Netherlands is satisfied about the taste. In Germany, this is one out of five. This brings us back to the topic of the unstoppable appetite for berries. If even inconsistent quality has not stopped consumers from eating more and more berries, there is still a world of opportunities for the berry market – provided quality and availability are both right. Hopefully, availability will not be stopped by increasing costs and lack of labor.

Read the full report at Rabobank.