During this year's Memorial Day, the tight meat supply created a starring role for fresh produce in many of the weekly ads. Additionally, social distancing measures prompted smaller gatherings and fewer people traveling for Memorial Day, resulting in continued elevated engagement with grocery retailing, and produce along with it. 210 Analytics, IRI and PMA partnered to understand how retail sales for produce are developing throughout the pandemic and as restaurants around the country are starting to re-open dine-in facilities.

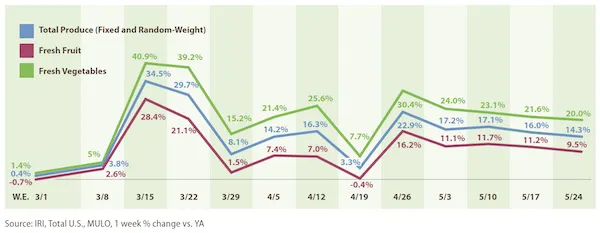

Memorial Day week elevated everyday and holiday demand drove double-digit produce gains for fresh, frozen and shelf-stable fruits and vegetables. Fresh produce year-over-year growth for the week of May 24 versus the comparable week in 2019 increased 14.3%. Fresh vegetables, up 20.0%, continued to easily outperform fruit (+9.5%). Frozen once more had the highest gains, up 33.8%, despite continued high out-of-stocks and severely limited assortment availability for both frozen vegetables and fruit.

- Fresh produce increased 14.3% over the comparable week in 2019.

- Frozen, +33.8%

- Shelf-stable, +24.6%

Source: IRI, Total US, MULO, % growth vs. year ago week ending May 24, 2020

Fresh Produce

Compared with the same week in 2019, fresh produce generated an additional $187 million in sales during the week of May 24, or an additional 122 million pounds. While strong, growth rates have dropped by one to two percentage points each week from the end of April. Fresh vegetables, at +20.0%, boasts double-digit increases for 10 out of the last 11 weeks.

“Our consumer survey work shows that many more consumers cook from scratch and that is a big opportunity for fresh produce,” said Jonna Parker, Team Lead, Fresh for IRI. “Importantly, in our surveys, nearly one-quarter of consumers (23%) predict that they will continue to cook from scratch more than they did pre-pandemic in the upcoming month.”

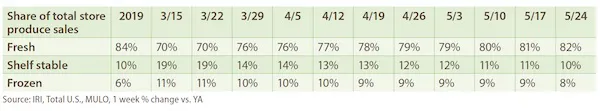

Fresh versus frozen and shelf-stable

Percentage-wise, gains in fresh produce are bound to be lower than frozen and shelf-stable due to its share of total store fruits and vegetables. “I’m very pleased to see that the fresh share of total fruit and vegetable dollars across the store is almost back to pre-pandemic rates,” said Watson. “In mid-March, consumers were in their stock-up mindset and diverted their dollars from fresh to frozen and canned. The share of fresh to total fruit and vegetable sales across the store stood as low as 70%, but in the latest week fresh is back to 82%.”

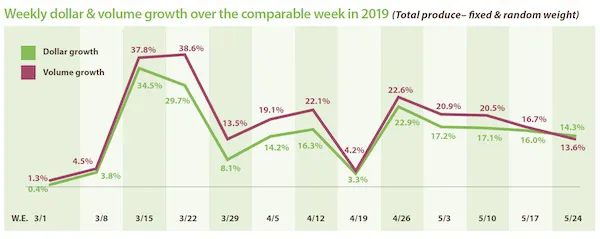

Dollars versus Volume

After narrowing significantly the week of May 17, the volume/dollar gap that once stood at nearly 9 percentage points completely vanished the week of May 24. In fact, dollars tracked slightly ahead of pounds for the first time. “Where other departments have seen inflation throughout the pandemic, prices were flat or down for most fresh fruits and vegetables until this week,” said Parker.

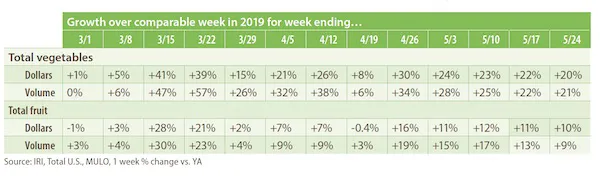

Vegetables still saw volume growth tracking ahead of dollars the week of May 24 versus the comparable week in 2019. However, the volume/dollar gap for fresh vegetables has come down to just 0.7 percentage points. In fruit, dollar gains outpaced volume gains for the first time since the onset of coronavirus in the U.S., albeit by less than 1 point.

The top three growth items in terms of absolute dollar gains over the same week in 2019 were lettuce, berries and potatoes. While the volume/dollar gap has dissolved overall, there are several vegetables were significant gaps remain, including peppers, avocados and onions.

“On the fruit side, we see strong demand across the board expressed in high volume gains versus last year. However, in some areas, ample supply is still suppressing prices which means there are continued significant volume/dollar gaps for items such as avocados (22 point gap), grapes (14 points) and apples (8 points),” said Watson. “For others, supply and demand are starting to balance out more and for items such as tangerines, mangoes, papaya and peaches dollar gains are actually outpacing volume.”

On the vegetable side, peppers, onions, Brussels sprouts and cauliflower are all vegetables with significantly higher volume than dollar gains. However, potatoes, corn and asparagus are examples of vegetables were dollar gains outpaced volume growth. “The strong demand and dollar delivery of sweet corn is an important sign that summer sales are off to a strong start,” said Watson.

To read the full report, click here.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

Email: aroerink@210analytics.com

www.210analytics.com