In the last ten years, European discount stores' business models have changed dramatically. They have been able to develop strongly. In the past, discounters were known for their simple business models. They offered inexpensive and private label products. Now, they are experimenting far more with different expansion tactics. They want to attract a much wider audience.

The shopping experience at these stores is increasingly starting to resemble that of a super and hypermarket. This is because of the expansion of the discount stores' assortments and the inclusion of more premium brands. They are also staying open longer, have added loyalty programs, and have sales campaigns.

These steps are, however, just the beginning. The discounters keep experimenting. Their business models are becoming increasingly advanced. These models include offering top-of-the-range brands permanently and price promotions. There is also far more focus on the stores' ranges, and they are revising their private labels. Significant efforts are being made to redesign their stores too.

Mapping the history of discount stores' growth

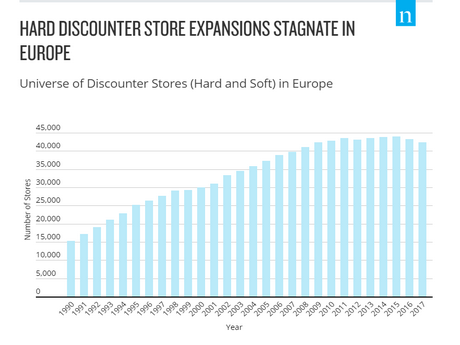

Traditionally, branch expansions have been the main reason for discounters' healthy growth. In 1990, there were about 15,000 of these stores in Europe. By 2017, this number had grown to 42,000. However, expansion by adding branches reached its limit in Europe. This trend eventually stagnated.

Source: Nielsen Discounter Database

Discount stores have, however, managed to gain market shares. This is despite the stagnation of the number of stores in recent years. Discounters are, in general, the main drivers of expansion in the market. The stores achieve this share increase mainly by offering premium brands.

These choice brands make up only a 30% market share. However, these products account for about half of the 8.8% total growth within the discount store sector. This is an excellent performance compared to Private Labels. Premium brands also attract new shoppers to the stores. Private Labels do not attract as many new customers.

See more graphs on the Nielsen website

Source: Nielsen