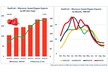

Slight increase in vegetable acreage due to increased tomatoes

Source: Centraal Bureau voor de Statistiek

Characteristic of greenhouse vegetable cultivation is the large export share. Marketing focuses on Western European markets. Reliable delivery and high quality play an important role.

Striking is the strong increase in consumption of sustainable labelled vegetables. Main competitor for the Dutch vegetable growers in the European markets is Spain. The competition is countered by providing year-round supply, with better lighting or by opening branches abroad.

The 2013 price trend for greenhouse vegetables was mostly favourable. Very negative exception was the tomato. The poor tomato prices were caused by fragmented supply, expansion of Dutch acreage, variety selection and an unusually high European production of tomatoes through the hot summer.

The cold spring resulted in higher variable energy costs, causing average returns for greenhouse vegetables to be under pressure again. Conversely, the yield of peppers companies increased through less production and a more concentrated supply. Cucumber yield remained unchanged.

Vision ABN Amro

Dutch vegetable growers operate in a saturated European market. Due to fragmented supply, increases in European and local production and increasing demands from customers, scaling continues. The main challenge for growers is the focus on distinctive products, which should avoid the continued competition on price. Dutch growers have to make use of their head start when it comes to the tastiest, freshest and most sustainable vegetables.

Growth opportunities lie outside the Euro zone by growing prosperity and the rise of supermarkets. These conditions also offer opportunities for Dutch fruit. Geopolitical tensions could be of great influence on the distribution, for example, by fluctuations in exchange rates and trade barriers.

Higher customer demands and a consumer preference for product differentiation are stimulating vertical cooperation. In vertical chains choices are made for specific customers, markets and products, increasingly based on fixed price agreements. The changeover to new chain models requires entrepreneurship and management skills of entrepreneurs. This begins with the question in which chain you are or want to be, and then make room for consolidation, specialization or a switch to another chain.

- The greenhouse vegetable acreage in 2013 increased slightly by 0.5%, mainly due to expansion of the tomato acreage. The acreage of peppers and cucumbers dropped.

- The tomato acreage grew in 2013 to a record high of 1,768 hectares. Especially the acreage of vine tomatoes swelled, to 1,256 hectares. The cherry tomato acreage decreased slightly, to 114 hectares. The remaining 398 hectares will be filled by loose tomatoes, which showed slight growth.

Export volume increases

- After a two-year decline, the export of vegetables (except for onions) increased by 1.8% in 2013. The increase can be largely explained by the increased production of tomatoes.

- Main markets are Germany and the United Kingdom. In both countries, sales increased slightly, mainly those of cucumbers and tomatoes. Exports of pepper declined due to decreased demand.

- The main export destination outside the EU is Russia. Exports to this country dwindled slightly for the second consecutive year. Main reason is that Russia imports more from neighbouring countries.

Average income decline in vegetable production

Source: LEI Wageningen UR, agrimatie.nl

- The average income of vegetable production declined in 2013, to just below zero. This decrease is mainly due to poor prices of tomatoes. The improved income of cucumber and pepper companies doesn’t compensate for the decline.

- The average cost rose slightly in 2013, due to increased variable energy and labour costs.

- Turnover declined by 4% in 2013, compared to the preceding year. The main reason was the price pressure of the tomato. Pepper companies actually benefited from better pricing. For cucumber companies, the average yield was similar to that in 2012.

Source: ABN Amro, visie op Groenten onder glas