This in turn means that prices have dropped, supply is still segmented and that producers are less inclined to export because of competition with other counties. In addition, profits are lower for producers and the power of distributors is increasing.

Italian product flows

Italy has over a million tons of tomatoes available between domestic production (945,000 ton, 89%) and imports (121,000, 11%). 87% (926,000) of the total is destined to the fresh market, 108,000 tons are exported and only 3% goes to waste.

The 926,000 tons are destined to the H&R (185,000 tons, 20%) and retail (41,000 tons, 80%) channels.

The international situation

Competition comes from both European and Mediterranean countries. The main competitors for Italy are Spain, Morocco and the Netherlands.

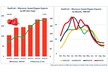

The main producer countries: left, Spain (blue), Turkey (grey), Egypt (dotted) and Morocco (yellow); right, Greece (blue), Netherlands (grey) and Italy (yellow). (Click here to enlarge).

Between 2007 and 2013, there has been a slight drop in Italian production. Techniques are increasingly complex and seeds and plants are expensive.

The main exporters

Seven of the ten main exporters worldwide are in Europe/Mediterranean area (Netherlands, Spain, Turkey, France, Belgium, Morocco and Italy). The remaining three are Mexico, US and Canada.

Table tomato exports. Exports of all the main producer countries have increased between 2008 and 2013, except for the US and Italy.

Italy does not export a lot of produce. What it does export, goes to Germany (33%) and Austria (17%) followed by UK (10%) Switzerland (8%) and France (6%).

In the past 5 years, imports were above 120,000 tons/year. The produce comes mainly from the Netherlands (39%), Spain (31%) and France (17%).

The market at origin: average ex-warehouse price (euro/kg) of bunch tomatoes. Spain is yellow, France is blue, Italy is grey and France of Spanish origin is dotted. (Click here to enlarge).

The market at origin: average ex-warehouse price (euro/kg) of cherry tomatoes (Spain is yellow and Italy is dotted blue). (Click here to enlarge).

The wholesale market: average price at origin of bunch tomatoes. Italy is yellow and Holland is blue. (Click here to enlarge).

In the last few years, the economic crisis and the drop in consumption meant people bought less produce. Demand of fresh tomatoes dropped by 1.6% per year, though average prices increased slightly. In 2013, one person ate 16 kg of tomatoes on average.