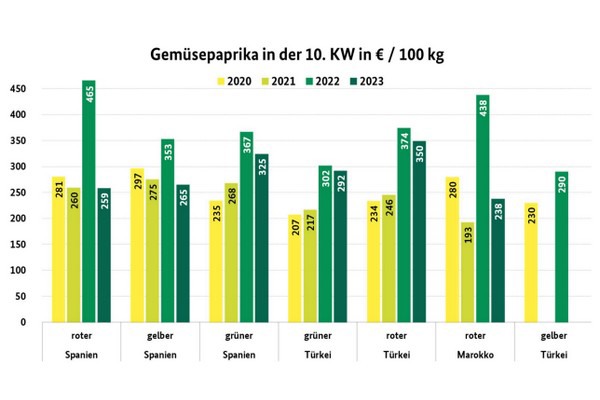

Due to the limited supply and nice demand, price increases were implemented for bell peppers of all colors of all origins. Green Spanish produce was at times not available at all or only sporadically in very small quantities in Munich; prices were most significantly increased for these. In Hamburg, customers had to pay up to €16 per 5-kg box for greens. However, other colors also became more expensive during the reporting week, some more noticeably than others. Spain dominated in all color categories, Turkish imports supplemented, and red Moroccan products rounded off the scene.

Both Turkish and Moroccan red products saw significant price increases during the reporting week. In Cologne, the first Dutch orange products were spotted by the weekend, while Frankfurt reported the arrival of the first Belgian green Californias, which were expected to cost up to €18.50 per 5-kg carton. In Berlin, a sufficient variety of products from Turkey arrived and generated increased interest due to the upcoming Ramadan.

Apples

The week was characterized by calm sales. Domestic batches, as usual, formed the basis of the assortment: Elstar, Braeburn, and Royal Gala gained slightly in importance and were offered at correspondingly lower prices.

Pears

After the Italian Abate Fetel was phased out of marketing, it was replaced by its counterparts from South Africa. In Frankfurt, they cost between €19 and €21 in the 6.5 kg carton for the 65+ and 70+ sizes. South African imports now significantly predominated.

Grapes

Regarding the assortment composition, nothing significant had changed: South African imports continued to dominate, while only a few light seedless products from Peru completed the product range. Supplies from Namibia had significantly decreased.

Oranges

For oranges, Spanish fruits were primarily available: Nave Late, Lane Late, and Salustiana as well as various Navel varieties were mainly available. Among the Egyptian supplies, Valencia Late and Balladi increasingly replaced Navels.

Small citrus fruits

The approaching spring noticeably slowed down the buying interest, so that the volume of the once so popular Nadorcott and Tango Gold from Spain significantly declined, signaling the end of the mandarin campaign. Israeli Orri followed this trend.

Lemons

Spanish Primofiori predominated over Turkish Lamas and a few Enterdonato, whose presence had overall decreased. Egyptian and Greek products no longer played a role and were now locally phased out of marketing.

Bananas

The week was marked by a calm marketing. Generally, supply and demand were sufficiently balanced, so that the prices did not change significantly. Only Frankfurt reported rising prices for all brands.

Cauliflower

Italian and French shipments prevailed, with Spanish deliveries supplementing the scene, though they were already nearing the end of the season. Locally, French and Spanish supplies had already slightly decreased.

Lettuce

Regarding lettuce, Belgian and Italian goods shared the market. From the early cultivation in greenhouses, Munich and Frankfurt also had small amounts of domestic lettuce available.

Cucumbers

While the presence of the dominant Spanish offerings was restricted, the importance of Dutch, Belgian, and domestic products visibly expanded. Customers increasingly switched from Spanish to Central European goods.

Tomatoes

A wide-ranging assortment remained available, in which Spain, Morocco, Belgium, and Italy had the greatest significance. Spain slightly restricted its supplies but continued to dominate in the vine tomatoes segment. Belgium, Turkey, and the Netherlands supplemented in this segment.

Source: BLE