The year 2020 was undoubtedly a tough year for logistics. Although the sector was definitely marked as essential in a time when people increasingly opted to have goods shipped to their homes, the sudden increase in demand meant that many logistics businesses had to play catch-up. Cold chain logistics specifically had to look for ways to increase efficiency in the shipping process, with the sudden spike in demand having to compete with considerations like climate change and various fruit and vegetable diseases.

Despite the challenges faced by cold chain logistics, however, there are some bright spots for the sector going into 2021. From 2020 to 2025, for example, the market for cold chain logistics in the Asia-Pacific region is anticipated to grow at a compound annual growth rate of more than 11%. Though this doesn’t necessarily mean a complete shift away from doing business in other regions, it’s clear now that the Asia-Pacific is the next frontier for cold chain.

Rising regional incomes

The Asia-Pacific spans a wide berth of countries including the likes of South Korea, China, India, and Indonesia—all of which are either developed countries or countries still marked for growth in the coming years despite the impact of COVID-19.

As incomes in the region steadily rise, so will the demand for higher quality, organic, or fresh products. This demand can already be seen in regions like the US and Europe, adding evidence that the trend could easily occur elsewhere. As a result, the Asia-Pacific is set to see a boom in cold chain-related opportunities and investments. Cold chain operators must also forge partnerships with manufacturers seeking to give their customers high-quality goods.

It should be noted that for the Asia-Pacific to equal the same cold storage capacity per urban capita that the US currently has, it will have to double its existing stock.

High demand for convenience

It isn’t just enough now that goods arrive at supermarkets. The rise of omnichannel grocery distribution, especially in countries like China, South Korea, and Japan, means that food needs to be transported to customer’s doorsteps as well. This is true especially in highly urbanized areas. To accomplish faster delivery, traditional supermarkets are also setting up distribution centers and smaller stores in consumer-centric areas.

The cold storage infrastructure in these areas will need to be able to not only keep perishable stock fresh but also enable easy transportation without any food loss, wastage, and quality concerns.

Aging population

Though several countries in the Asia-Pacific region have populations with a median age of below 30 years old, some skew much older. A third of people in Japan are 60 or older and this segment makes up a quarter of the population in South Korea.

An aging population means a bigger pharmaceutical market, of which cold chain plays an irreplaceable role. Cold chain management prevents sunlight and humidity from ruining essential treatments like vitamins and minerals or even raw materials such as bulk compounds.

In 2019 alone, cold chain logistics already accounted for more than 26% of the pharmaceutical industry. This figure seems only likely to increase in the next decade.

Urgent need for COVID-19 vaccines

One cannot mention the increasing demand for cold chain logistics without going beyond food storage and mentioning COVID vaccines, most of which are only sustained at especially low temperatures. For instance, the vaccine from Pfizer must be kept at -70 Celsius. Moderna’s must be kept at -20 Celsius.

As the region with by far the largest population in the world, cold chain logistics will be a crucial part in getting life in the region (and by extension, the rest of the world) back to normal.

Leaders in the region have shown no hesitation in sinking investments. Just in mid-December, the Asian Development Bank (ADB) has spent $9 billion (USD) on a facility meant to help nations access and deliver COVID-19 vaccines. The initiative will provide support for the transport of vaccines to ADB’s developing members and investment in crucial cold storage facilities. This proves that the region not only has high levels of demand that can sustain the cold chain logistics sector, but the finances to back it up as well.

With the Asia-Pacific clearly chock full of future opportunities for cold chain, the competition among logistics solution providers promises to be fierce. To gain a competitive edge, businesses must keep an even closer eye on their supply chain.

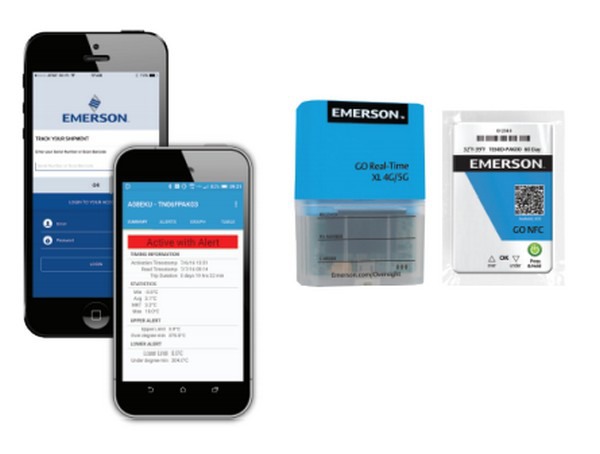

Fortunately, technology has evolved to make it easier than ever for businesses to ensure freshness and safety along the supply chain. Some manufacturers such as Emerson have created solutions that allow for real-time tracking of a product’s temperature. Emerson’s GO Real-Time 4G/5G Tracker utilizes cellular technology to provide real-time alerts on a product’s status, including data on temperature, humidity, and location.

In conjunction with Emerson’s line of refrigeration data loggers, monitoring temperature and time of the environment of perishables in-transit or during storage can be as easy as plugging a USB. Once connected data is immediately generated containing temperature history, graphs and summary data. Easy to use when combined with the Oversight dashboard and Oversight Mobile app, providing robust reporting of critical information such as temperature, security, and location details.

When it comes to pivoting to the Asia-Pacific, its crucial businesses don’t hold back. Although there will be challenges in meeting the rising demands of a region in flux, the efforts will surely be paid back tenfold.

For more information:

CargoAsia@Emerson.Com