Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) says while the horticulture industry will suffer significantly from labour shortages, there are some opportunities from high domestic demand.

A senior industry economist at ABARES, Charley Xia, told this week's Outlook 2021 conference that there are two key factors driving up prices; production affected by workforce challenges and retail demand.

"Retail prices of fruit and vegetables have stayed quite high compared to the past five-year average in each of the four quarters (of the year)," he said. "The pandemic forced many Australians to stay at home and the closure of borders. This resulted in reduced labour supply for the sector. While seasonal conditions improved in most growing regions, especially for those in New South Wales and Queensland, there were significant issues in harvesting that produce in order to meet that increased demand. With harvests now moved across to the southern growing regions, during summer and autumn, we are forecasting production losses."

Photo: Charley Xia (left) on a Q&A panel discussing horticulture labour challenges at Outlook 2021.

Earlier in the week, ABARES reported that the lack of supply in overseas harvest workers, particularly from the Working Holiday Maker program, will result in a forecast drop in fruit production by as much as 17 per cent and vegetable production by around 2 per cent. This drop in production will ultimately impact consumers, with ABARES forecasting prices to increase between 7-29 per cent.

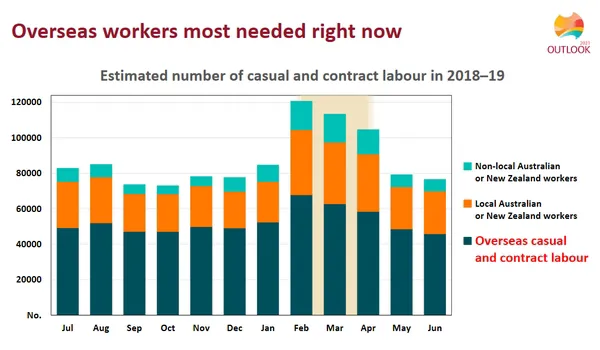

"Those prices are expected to remain high in this financial year and into the next," Mr Xia told the conference. "We think that production losses will be most significant right now in late summer and early autumn. This has been informed by farm survey data, showing that the employment of casual and contract labour on horticulture farms. In 2018-19, numbers fluctuated around 80,000 workers per month from July to January before spiking to 120,000 in February. Overseas workers, mainly backpackers were the majority of those employed."

He added that with international borders unlikely to reopen in the short term, there are not enough local workers to make up for the losses of these workers in regional areas. This means that the impacts of labour shortages on regions and produce will be felt differently, with the biggest disruptions taking place right now.

"It is in the increased labour needs of the southern growing regions during February to April that we think poses the greatest risk to production," Mr Xia said. "This leads us to forecast that fruit production over summer and autumn will be worst affected, especially stone fruit, pome fruit and table grapes will be worst affected. We also think that vegetable production will be less than fruit and that is because vegetable farms are located closer to cities with better access to labour. Also, the scale of production on vegetable farms tend to be smaller, which means that family members can often make up the shortfall of needs."

The high consumer demand is also leading to strong prices, according to Mr Xia, because many Australians are spending more time at home than before the pandemic.

"The increased consumption at home will support retail demand," he explained. "We are not expecting the demand to reach the levels of last year (when the pandemic began), but we see that grocery spending drove the majority of the increase in retail turnover in 2020. We do think that there will be changes in consumption patterns, including more emphasis on healthy eating and food to accommodate people working from home. That is likely to continue in the short term. We also don't think that Australian consumers will significantly increase purchases because of the high prices. This isn't because there are few substitutes for fresh produce, but because spending on them is a really small component of household budgets."

ABARES forecasts the value of Australian horticulture to drop to just $12.8 billion and the National Farmers' Federation says that is a "far cry" from the predicted $20 billion it needs to be for agriculture to reach its goal for this next decade.

"Horticulture was predicted to be the growth industry as part of our $100 billion goal by 2030 for Australian agriculture," NFF Horticulture Council Executive Officer Tyson Cattle said. "However, if we can’t access an efficient, competent and reliable workforce to get the crop picked and packed, we will struggle to reach that goal. The situation is only getting worse for our horticulture growers across the country. Our growers are in desperate need for harvest labour and have been for the better part of a year."

ABARES showed that the number of Working Holiday Makers had declined 64 per cent in 2020, with the industry continuing to urge governments to increase its quarantine capacity and prioritise bringing in seasonal workers, or face a declining horticulture sector and increased prices for the consumer.

ABARES Outlook 2021 is being hosted by the Australian Government Department of Agriculture Water and the Environment. It is being held virtually for the first time, to be run over four days with presentations aimed at the different agriculture themes and sectors, with more than 1,200 delegates.