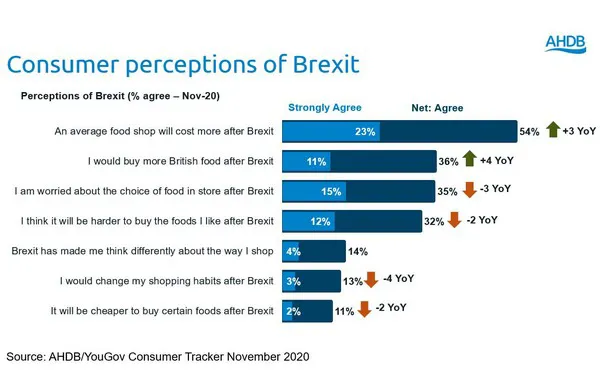

YouGov data from before the deal was agreed in November 2020, suggests that the biggest immediate concern for consumers of leaving the EU is the impact on food prices. Over half (54%) think that prices will rise. This is not an unfounded fear: even with a deal in place, it is likely that there will be some inflationary impacts on shopping baskets due to increased friction and complexity in supply chains. These prices will ultimately be passed on to the consumer.

Lack of availability?

Concerns about availability of foods post-EU exit are now more limited, with only 1 in 3 consumers believing this will be an issue. At the time of the event we saw limited evidence of consumers stockpiling in readiness for the EU exit. Perhaps the exit, coinciding with the Christmas period when many larders are over-stocked anyway, may have softened that impact.

Impact on demand for British produce

There is a sense that the EU exit could encourage some consumers to look more proactively for British foods. According to IGD, the vast majority of consumers (81%) believe that the UK should be more self-sufficient when it comes to food production. However, this does ignore the realities of climate on production of some staple products such as fruit, and consumer demand for products out of season in the UK. However, 70% feel that it is more important to buy British at the moment and a further 59% feel that the EU exit might encourage them to source their food more locally.

Opportunities and challenges

There is certainly more positivity towards the idea of buying British currently and producers and retailers should be sure to tell their provenance story where possible, to make it clear where their product comes from. This should go beyond simply ‘putting a flag on it’; it is vital that communication includes what that flag delivers for the consumer in terms of quality, ethical values and heritage. However, as we are likely to be in the teeth of an economic shock over the next 18 months, price premiums will increasingly need to be justified.

For more information: ahdb.org.uk