The first week of June marks three full months of coronavirus-related shopping patterns. While restaurant competition for the food dollar is gearing up, grocery sales remained highly elevated. Additionally, trends in trips, basket size, product selections and channel choices continue to change as pandemic shopping develops. This results in an ever-changing demand landscape for fresh produce, and frozen and canned fruits and vegetables along with it. 210 Analytics, IRI and PMA partnered to understand how retail sales for produce are developing throughout the pandemic and as restaurants around the country are starting to re-open their doors.

During the first week of June, elevated everyday demand drove double-digit produce gains for fresh, frozen and shelf-stable fruits and vegetables. Fresh produce year-over-year growth for the week of June 7 versus the comparable week in 2019 increased 13.2%, the exact same gain as the week prior. Year-to-date, fresh produce sales are up 10.5% over the same time period in 2019. Frozen fruit and vegetables increased the most, up 22.3%. This gain is in spite of limited assortment availability for frozen vegetables and fruit, down 9.5% in average items per store selling.

Fresh Produce

Fresh produce generated $1.4 billion in sales the week ending June 7 — an additional $166 million in fresh produce sales. Vegetables, up 17.1%, still outperformed fruit (+10.0%), but the gap was the smallest it has been since mid-March. Additionally, this is the first week since early May that sales gains held steady versus the slow erosion seen each week. Fresh vegetable gains have been double digits for 12 out of the last 13 weeks.

“Last week, we saw cherries lead all produce categories in absolute dollar gains versus year ago. This week, fruit has significantly narrowed the gap with vegetables, once more with a big performance by cherries,” said Jonna Parker, Team Lead, Fresh for IRI. “As we saw in prior weeks, the trends of old are holding true even amid the pandemic. The summer season is in full swing, which means we need to optimize impulse and planned purchases to the fullest extent possible. Our weekly survey finds that consumers are looking to treat themselves and are tired of the same meal lineup. Fragrant, colorful, seasonal fresh fruit is a great way for the store to help provide that for them.”

Fresh versus frozen and shelf-stable

Shoppers on the Retail Feedback Group’s Constant Customer Feedback (CCF) program commented on the improved availability, quality and freshness in the produce department in recent weeks. One shopper wrote, “I always find the freshest produce and have been extremely pleased with the large selection during the COVID crisis. Produce is my most important area to shop in the store.” At $1.4 billion in sales during the week of June 7, fresh produce is significantly larger than shelf stable ($169 million) and frozen fruits and vegetables ($135 million). This means that despite lower growth percentages, fresh has been gaining back much of its lost share. “During the stock up weeks, the share of fresh produce fell to a low of 70%,” said Watson. “During the first week of June, we had to give up a percentage point to shelf-stable, but fresh sales are certainly in much better shape than March and April.”

Other consumers thanked the store for the extra hygiene-focused measures, “I appreciate that there were hand sanitizing stations at both ends of the produce department since this would be an area where people would be ‘touching’ to inspect the produce before they make their purchases.” Out-stock-comments were few and far between, and IRI data shows an increase of 1.9% in the average number of fresh produce items sold per store.

Fresh Produce Dollars versus Volume

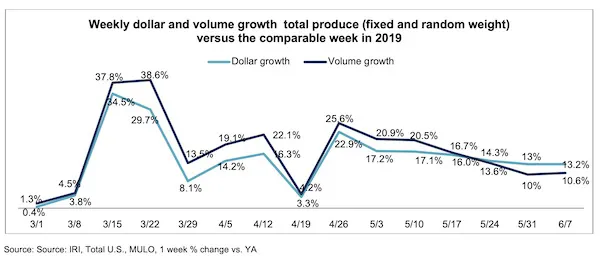

With dollar gains unchanged at +13.2% during the week ending June 7, but volume sales accelerating slightly to +10.6%, the gap between fresh produce volume and dollar gains narrowed slightly to 2.6 percentage points.

Both fruit and vegetables saw volume growth tracking ahead of dollars the week of June 7 versus the comparable week in 2019. However, the volume/dollar gap for fresh vegetables was increased to more than three percentage points. In fruit, dollar gains tracked 1.7 points ahead of volume this week, less than the week prior.

The top three growth items in terms of absolute dollar gains for the week of June 7 versus a year ago were cherries, lettuce and tomatoes. “Just barely beaten out by tomato sales gains, berries dropped out of the top three drivers of new dollars for the first time in many weeks due to cherries having a massive week once more,” said Watson. “Cherries delivered an additional $25 million versus the same week year ago, representing a nearly 80% increase in dollars and +104.6% in pounds. Oranges and potatoes remained pandemic powerhouses even in the midst of the summer season with gains of 57.4% and 23.7% over the same week in 2019.”

Strong demand is driving volume along with dollar gains across the board. While some fruits and vegetables are seeing inflation, for others, prices remain depressed. Inflation is seen for several tropical fruits, including mangoes, tangelos and tangerines. On the vegetable side, prices for potatoes, corn, beets and garlic are up double-digits over year ago. Continued volume/dollar gaps persist for other areas, including avocados, cherries, grapes and plums. “The strengthening demand coming out of foodservice combined with the continued elevated demand seen in retail will continue to balance out supply and demand in the coming weeks,” said Watson.

To read the full report, click here.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

Email: aroerink@210analytics.com

www.210analytics.com