Hort Innovation have been funding a multi-industry project MT17019 – Regulatory Support & Coordination, focused on issues relating to chemical access for horticultural industries. The project is managed by a nationally recognised expert on pesticide regulation and risk assessment. Kevin has more than 35 years experience in the areas of pesticide development, use and regulation, both within government and the private sector, and currently is consulting to Australian agricultural industries, government agencies, RDCs and internationally with the United Nations – Food and Agriculture Organisation (FAO).

Greenlife Industry Australia asked Kevin to provide his insights on the future pesticide challenges facing Australian nursery production in light of the recently completed Nursery Industry Agrichemical Regulatory Risk Assessment.

1. What are the biggest changes and challenges in the agrichemical industry for horticulture?

KB: Aside from managing pesticide resistance and incursions of exotic pests and diseases, going forward I think a big challenge for horticultural industries will be ensuring there are enough tools for growers to manage their pest, disease and weed problems.

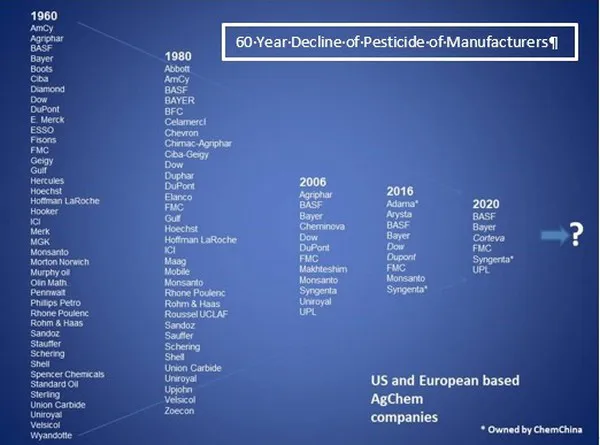

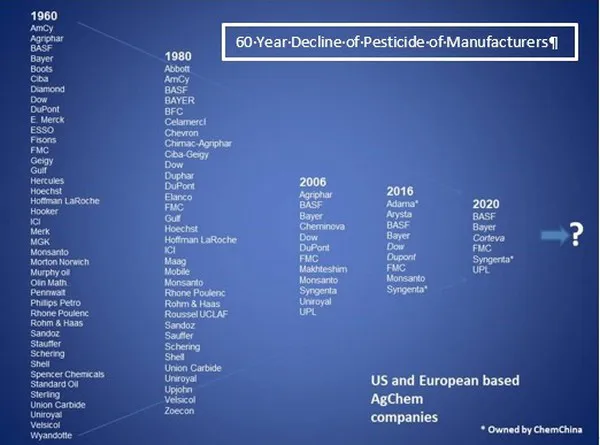

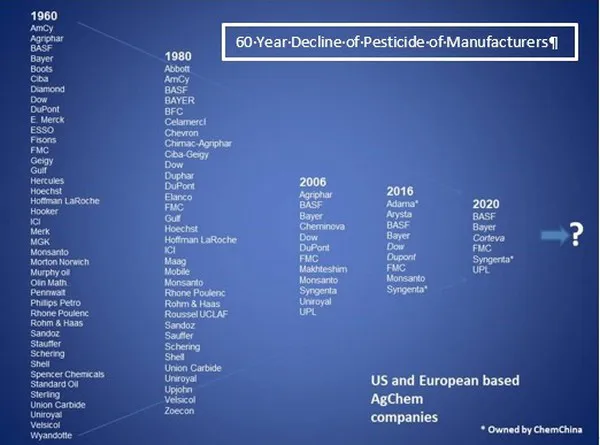

The pool of available pesticide choices is decreasing with the number of existing options declining and fewer new replacements being developed. From a Nursery Industry perspective this is a result of three main drivers. Firstly, there has been a continuing trend in company mergers and acquisitions reducing the number of manufacturers developing new products. As a result, there is likely to be fewer companies involved in research, plus following mergers we see a rationalising of existing product portfolios, which in the mid-term, could result in fewer chemistries/technologies being retained or developed and brought to market.

Secondly, in global terms Australia is a relatively small plant protection market, with herbicides making up more than half. For horticultural industries, gaining access to new technologies could become more difficult as the cost of developing uses for many of the smaller Australian horticultural industries may not be seen as commercially justifiable when looked at on a global cost-return basis.

Lastly, regulatory pressures on farm (production nurseries) chemicals are increasing internationally and in Australia. Older chemistries are being re-evaluated to ensure they comply with current health and environmental standards with regulators applying newer risk assessment methodologies, for which data is often unavailable.

The scope of pest management options available to growers is finite, so any factor that potentially reduces options can have an impact.

2. What are the issues that industry needs to be concerned about in relation to chemical/pesticide use in the nursery industry moving forward?

KB: I think probably the main issue moving forward will be access to new technologies that best fit with industry practices and constraints. The relatively small size of the Australian farm chemical market can often result in new technologies, when brought to Australia, being initially developed in major crops, delaying access for minor crops. This can often result in a lag of a number of years before a registrant seeks to expand label uses, assuming it has a fit.

A positive of the Australian regulatory system is the ability to gain permitted uses. Where the Australian Pesticides and Veterinary Medicines Authority (APVMA) is satisfied a proposed use complies with regulatory standards, off-label uses can be approved allowing growers to access new pest management options. This provides a potential pathway to gaining access earlier to a new technology or to an existing option where a gap has been identified.

Note: Greenlife Industry Australia (GIA), under the Hort Innovation levy funded National Nursery Industry Biosecurity Program, manages the industry’s pesticide minor use program (off-label) with more than 15 new actives introduced into nursery production over the past 3 years.

3. Recently, growers have been invited to provide feedback to reviews on current pesticide/chemical use in horticulture industries? What is driving this?

KB: Australia applies a risk-based approach when assessing farm chemicals. The risk assessment methodologies, now employed by the regulatory authorities have progressed, so the purpose of the reviews is to ensure approved uses meet those contemporary health and environmental standards. As most of the chemicals under review were last assessed some time ago, it has been seen as prudent that they be re-evaluated. To try and ensure their risk assessments are based on current practices the APVMA seeks input on specific pesticide related work practices, that is, how do growers use the pesticide?

4. Some chemicals could be lost to the industry? What are the implications for growers?

KB: I would expect that the implications could be significant, should the outcome of a chemical review be the cancellation of a use, particularly if it involves something that is widely used. Where cancellation is recommended, industry would need to consider whether an alternative is needed, engage with registrants and the APVMA, particularly if access via an APVMA permit is the best pathway in the first instance.

5. What should industry and growers be doing moving forward to ensure access is maintained to agrichemicals?

KB: I believe the thinking around pest management going forward needs to be strategic and growers need to operate under a more knowledge based system, such as Integrated Pest Management (IPM), to ensure they protect the products they currently have and avoid pesticide overuse and resistance. To be effective this will need stakeholders to be well informed and growers may need to change certain pest management practices. To achieve this, it is going to require industry engagement with new systems as well as the pesticide registrants and the regulator regarding specific chemicals, and the government where policy initiatives are being considered.

6. What are the challenges of maintaining or retaining access to chemicals/pesticides?

KB: The challenge for industries will be to recognise that loss of, or restricted access too many older production nursery chemicals under reconsideration is a possibility and that they need to be strategic when considering pest management options and their availability in the long-term. For example, for industry to try and satisfy regulatory requirements for an old production nursery chemical could be prohibitively expensive with no guarantee of a positive outcome, whereas pursuing a newer technology or pest management system may be a more effective approach from a long-term perspective.

Greenlife Industry Australia (GIA), through the Hort Innovation funded project NY15004 National Nursery Industry Biosecurity Program, manages the industry pesticide minor use program which aims to secure access for growers to new chemistry across insecticides, fungicides and herbicides. Since 2015 GIA has successfully applied for and received approval of more than 20 new pesticide actives with minor use permits in place.