In the ninth week of coronavirus-related shopping, patterns continued to evolve. Between the typical Mother’s Day sales boost and shoppers flocking to the store once more to stock up on meat amid ongoing coverage of shortages, grocery sales had another good week, and produce along with it. Trip, spending and channel choices continued to be in flux and fresh e-commerce is here to stay. All these developments had significant impact on fresh produce sales. 210 Analytics, IRI and PMA partnered to understand the effect for produce in dollars and volume throughout the pandemic.

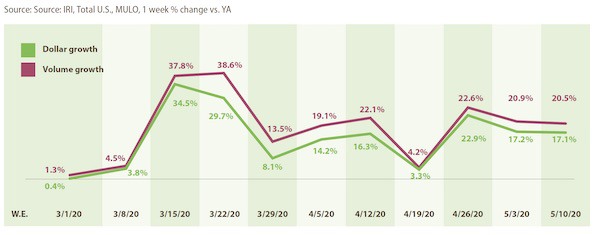

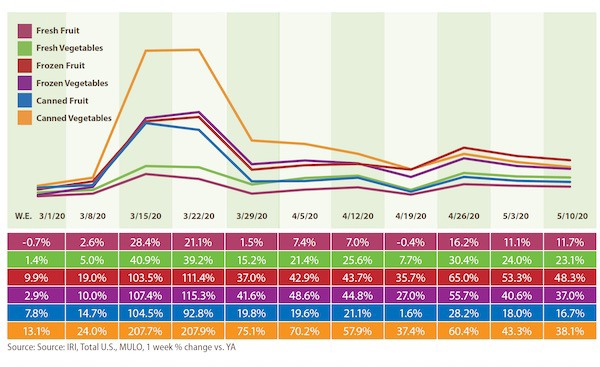

Fresh produce gains remained highly elevated the second week of May. Fresh produce growth for the week of May 10 versus the comparable week in 2019 increased 17.1% — virtually unchanged from the prior week. Fresh vegetables continued to easily outperform fruit, but both achieved double-digit increases. Meanwhile, consumer interest in all three temperature states for fruits and vegetables continued, with dollars split between fresh, frozen and shelf-stable. Frozen once more had the highest gains, up 39.2%, despite continued high out-of-stocks in the frozen food aisle.

- Fresh produce increased 17.1% over the comparable week in 2019.

- Frozen, +39.2%

- Shelf-stable, +28.8%

Source: IRI, Total US, MULO, % growth vs. year ago week ending May 10, 2020

Fresh Produce

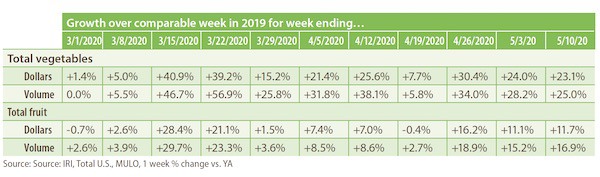

Compared with the same week in 2019, fresh produce generated an additional $209 million in sales during the week of May 10. Growth rates were in line with last week’s levels. Fresh vegetables, at +23.1%, continued to easily outperform fresh fruit and boasts double-digit increases for eight out of the last nine weeks.

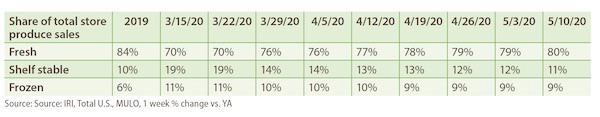

Fresh versus frozen and shelf-stable

Percentage-wise, gains in fresh produce are bound to be lower than frozen and shelf-stable due to its share of total produce. “Slowly but surely fresh is getting back to the market share it had pre-pandemic,” said Watson. “When shoppers were in their stock-up mindset, the share of fresh to total fruit and vegetable sales across the store stood as low as 70%, but in the latest week fresh is back to 80% despite some deflationary pressure.” Both frozen and canned have upward pressure on prices since the onset of coronavirus in the U.S.

Dollars versus Volume

The volume/dollar gap narrowed slightly the week of May 10 to 3.4 percentage points, down from 3.7 points. However, this is much diminished from the week ending April 22, when the volume/dollar gap was 8.9 percentage points. “Produce is one of the few departments where volume is tracking ahead of dollars,” said Watson. “While week after week we are documenting deflationary pressure for many fruits and vegetables, the most recent Bureau of Labor Statistics (BLS) on the Consumer Price Index (CPI) shows that food-at-home increased 2.6% over the month of March.

Both vegetables and fruit saw volume growth tracking ahead of dollars the week of May 10 versus the comparable week in 2019.

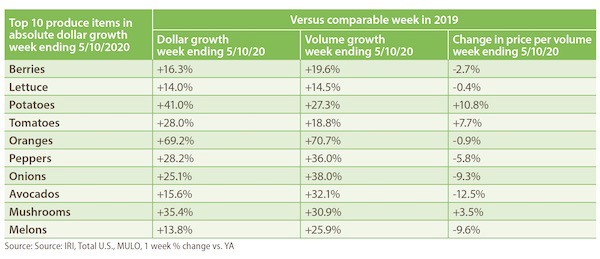

The top three growth items in terms of absolute dollar gains over the same week in 2019 were berries (+$26 million), potatoes (+$23 million) and lettuce and potatoes (+$22 million, each) and tomatoes (+$19 million). However, at the category level, big differences continued to exist between dollars and volume, driven by deflationary pressure. Within the top 10 growth items in absolute dollars, significant volume/dollar gaps remain for items, such as avocados, onions and melons.

“On the fruit side, we saw significant decreases in the price per volume versus the same week last year for items such as pineapples (17 percentage point decline), peaches (14 points), avocados (13 points) and melons (10 points),” said Watson. “For each, we see volume sales far exceed dollar sales, so the consumer demand is there, but the market conditions are putting pressure on price. But we are starting to see a few areas with price increases too, including tangerines, up +11% in price per volume versus year ago.”

On the vegetable side, there continued to be significant volume/dollar gaps in several areas. For instance, onions had a strong 25.1% boost in dollars, but volume sales were up 38.0%, with the retail price per volume down more than 12%. Others with high dollar/volume gaps were celery (30 percentage points), Brussels sprouts (27 points) and cauliflower (15 points). On the other hand, we saw some upward pressure as well for other items, particularly potatoes, with dollar sales still going strong, at +41.0%, and volume up 27.3%. Average price paid (dollars divided by volume) for potatoes was 10.8% higher versus the same week last year.

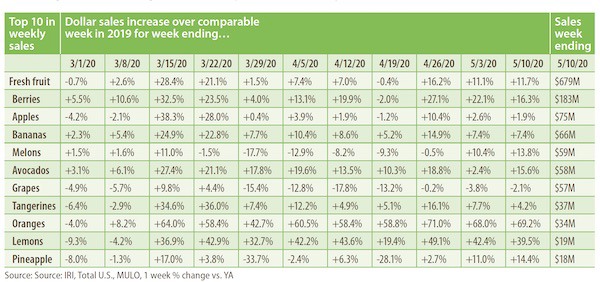

Fresh Fruit

“Fruit is hitting its stride here in the past few weeks,” said Parker. “While vegetables have seen a stronger performance during the pandemic, it is also fair to point out that vegetables had been outperforming fruit for a few years. The pandemic amplified that difference, but we see continued strength in items like oranges, lemons, avocados and berries — all sales powerhouses.” Seven out of the top 10 items in terms of dollar sales saw double-digit increases during the week of May 10 versus the comparable week in 2019.

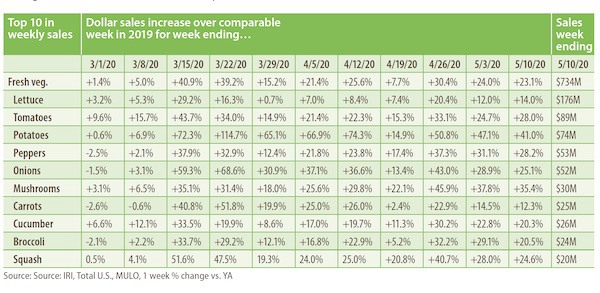

Fresh vegetables

All top 10 vegetable items in terms of dollar sales gained double-digits the week ending May 3, with increases ranging from +12.0% for lettuce to +47.1% for potatoes. “This is elevated everyday demand at work,” said Parker. “Excellent and prolonged gains in items like lettuce, potatoes, peppers and onions can only mean one thing: America is cooking. And that will have positive impacts for a long time to come.”

Lettuce was the top sales category, but potatoes were the top contributor in absolute dollar growth in vegetables, adding $23 million in sales versus the comparable week in 2019.

Fresh Versus Frozen and Shelf-Stable Fruits and Vegetables

Consumers continued to split their fruit and vegetable dollars three ways during the week of May 10. In addition to the strong performance of fresh vegetables, frozen and canned vegetables had ongoing strong growth during the second week of May as well. Vegetables continued to have higher gains in shelf-stable, but frozen fruit is gaining faster in frozen.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

Email: aroerink@210analytics.com

www.210analytics.com