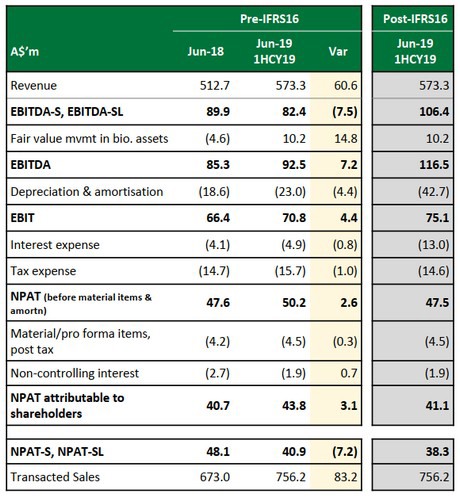

For the six months to June 30, Costa grew its revenue by 11.8% on the prior corresponding period to $573 million.

However, EBITDA before SGARA, leasing and material items (EBITDA-SL) came 8.4% lower at $82.4 million and statutory net profit after tax fell 15% to $41.1 million. The latter was inclusive of material items and amortisation of intangibles relating to the African Blue acquisition.

Management advised that adverse conditions during the Moroccan blueberry season, low mushroom demand, raspberry quality, and the impact of citrus water cost and fruit fly weighed on its performance in the first half.

Despite this, Costa is tracking broadly in line with the lower end of its revised target range outlined at its annual general meeting. As a result, it declared a fully franked dividend of 3.5 cents per share. This has a record date of September 12 and a payment date of October 3.

Costa Group CEO, Harry Debney, said: “We were faced with a number of challenges during 1H CY2019, including adverse conditions during the Moroccan blueberry season, low mushroom demand, varying raspberry quality, and water costs and fruit fly impacting the citrus category. All of these occurrences made for a difficult period.”

He advised that the company is concentrating on mitigating the challenges it has faced in CY2019 and is highly focused on major business initiatives to ensure strong delivery in the 2020-2022 period.

“The company has a number of initiatives across our categories which are very much focused on improving our performance and profitability. This includes expanding our berry varietal breeding program – both sub-tropical and tropical, commercial plantings of new citrus varieties and trialling of high density, trellised and protected avocado cropping,” said Mr Debney.

However, although its results thus far are in line with the lower end of its recent guidance, it has warned that “trading and forecasting remains challenging with potential further downside risk” due to “continued lower than expected pricing of mushrooms, raspberry crumble proving to be more significant and taking time to mitigate, and potential blueberry pricing pressure due to significantly higher than anticipated estimated NNSW blueberry industry crop.”