We analyzed the current stats of tomato production and pricing within the EU, both for the fresh market and processing industry.

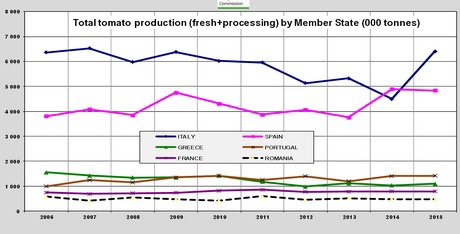

The data on the dashboard shows that the Italian tomato sector is currently still the biggest producer of tomatoes in the EU. Driven by processing tomatoes, the country's industry has seen an increase in production over the last 2 years and grew from 4,500,000 tonnes in 2014 to 6,500,000 tonnes in 2015. The year before that, the Spanish production, which is mostly fresh market, saw a big increase; from 3,800,000 tonnes in 2013, to almost 5,000,000 tonnes in 2014.

In regards to the total tomato production in the EU, the fresh market tomato industry has the most stable production; aside from some ups and downs, this market accounted for an average of 7,200,000 tonnes per year over the past decade.

Spain is still the largest fresh tomato producer in the EU with an estimated production of more than 2,000,000 tonnes per year. Italy is the second largest producer of fresh tomatoes with 1,000,000 tonnes per year, followed by the Netherlands with 900,000 tonnes in 2015. France and Greece both produced about 600,000 tonnes in 2015.

The market for processing tomatoes has been less stable over the past 10 years. While the EU produced about 9,000,000 tonnes in 2006, the production peaked to nearly 11,000,000 tonnes in 2009, followed by a sharp decrease towards 7,500,000 tonnes in 2013. Over the last couple of year the production again saw a steep increase with more than 10,000,000 tonnes produced in 2015 and 2016.

Looking at a map with the top world importers of tomatoes, it is remarkable to see that Germany is the second largest importer of tomatoes in the world, after the United States. In 2015, Germany imported tomatoes for a value of 1,2 billion USD and the United States for a value of 2 billion USD.

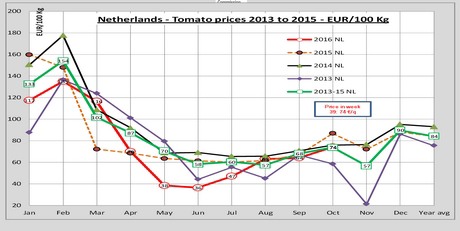

Furhermore the dashboards gives a good and up-to-date overview of current pricing up to two weeks ago. It is remarkable to see that of all countries, the Dutch growers received the lowest price for a kilo of tomatoes. In the same week that Spanish growers receive 1,04 for a kilo, the Dutch only receive 74 cents per kilo. In week 39, French growers received 82 cts per kilo and Italian growers 95 cts/kilo.

Click here for the complete EU Tomato Dashboard